Marketing and Agencies: Thoughts

Tl;DR

After tinkering with APIFY, it was obvious I needed to built something around marketing and sales…

+++ and reading some mkt resources / books

Intro

…I mean, to build it with the end in mind.

Generate cash flow.

Your interest are often potentially benefitial to others.

But most likely, you have started shipping/executing/just doing for free to wrong prospects if what you try to create is a business.

So: you are done already with the 3 F’s?

Yea, that stage of trying to sell to family friends and fools

Time to do some OpEx - in this case: marketing

Do you want to go via ads?

via organic posting/bip and social media?

Or via cold email?

Marketing Examples

In the end of last year I found this: when looking for nextjs web apps on yt

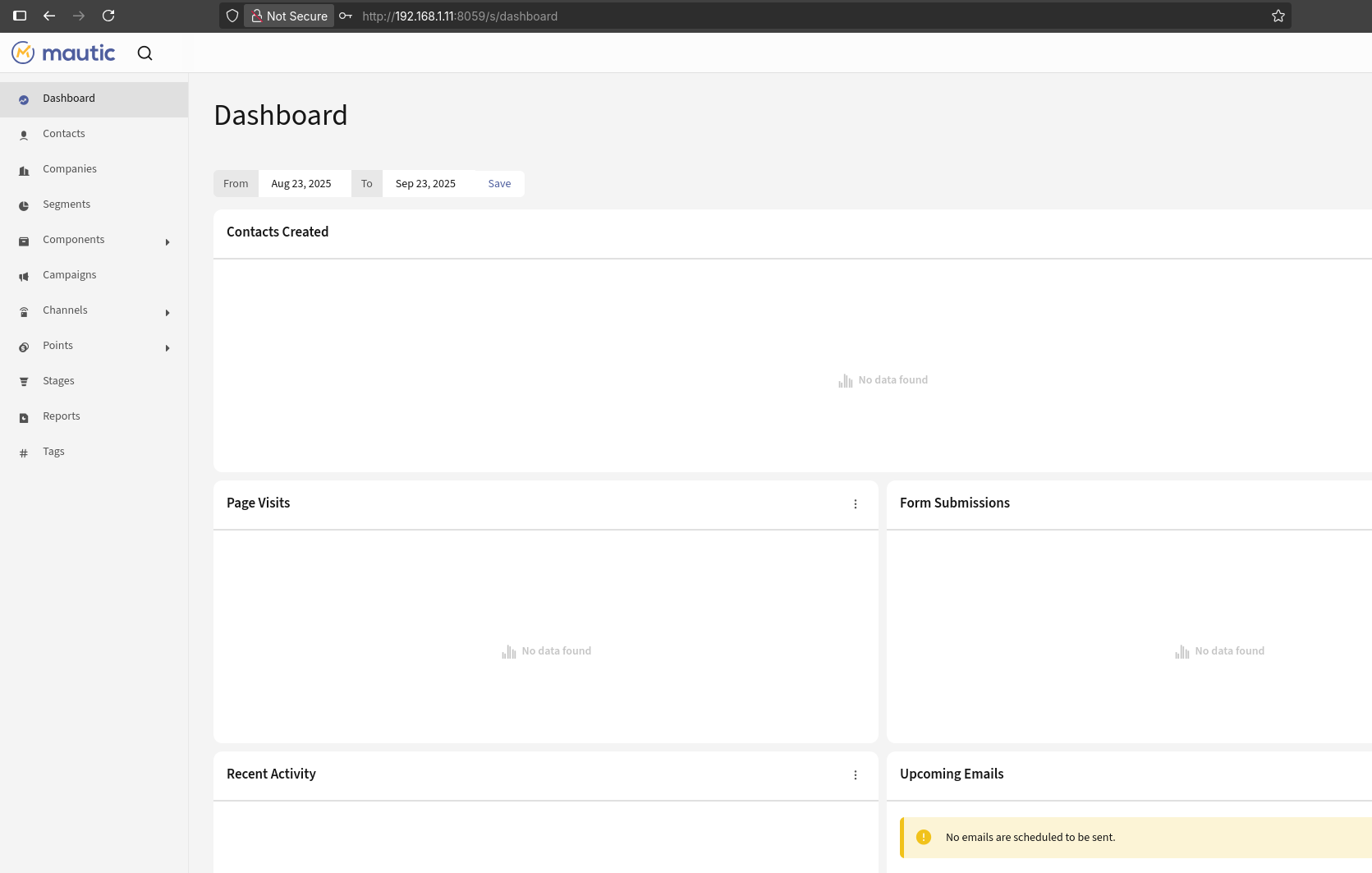

Example 1: https://lastcodebender.com/ and https://www.youtube.com/@thecodebendermaster/videos

An example of marketing? https://www.codebender.ai/#bottom

CONGRATULATIONS! YOU QUALIFY:

You're a perfect fit for The Premium AI Agency System. The next step is to book your

AI Business Assessment below.

Spaces are limitedGreat, I qualify for your emails:

Who could have guessed: * I qualify to enter your marketing list*

And how could have I not used gemini to understand the strategy better

Example 2

Need B2B sales ideas? See https://mongemalo.com/

After placing your mail, you get: https://mongemalo.com/rechazado/

And once you confirm it: https://mongemalo.com/importante-mensaje/

You are already prompted to buy an info product: https://youtu.be/kwIgobHPwxY

Example 3

For copywriting, see Isra Bravo.

And the book Cashvertising.

Conclusions

Do you know what game are you playing?

Then and only then, you will know how to win.

But they all work with the same schema: PVGMOMFT=NetProtift*

Or the full stack formula as Ill call it from now.

Dont get frustrated if you have been talking to an empty room so far.

Fix it.

Iterate.

Win.

You can get these kind of knowledge dumps from your Context.md library into email your leads are reading.

Providing you have both: a KB and potential leads captured properly into your sales pipeline.

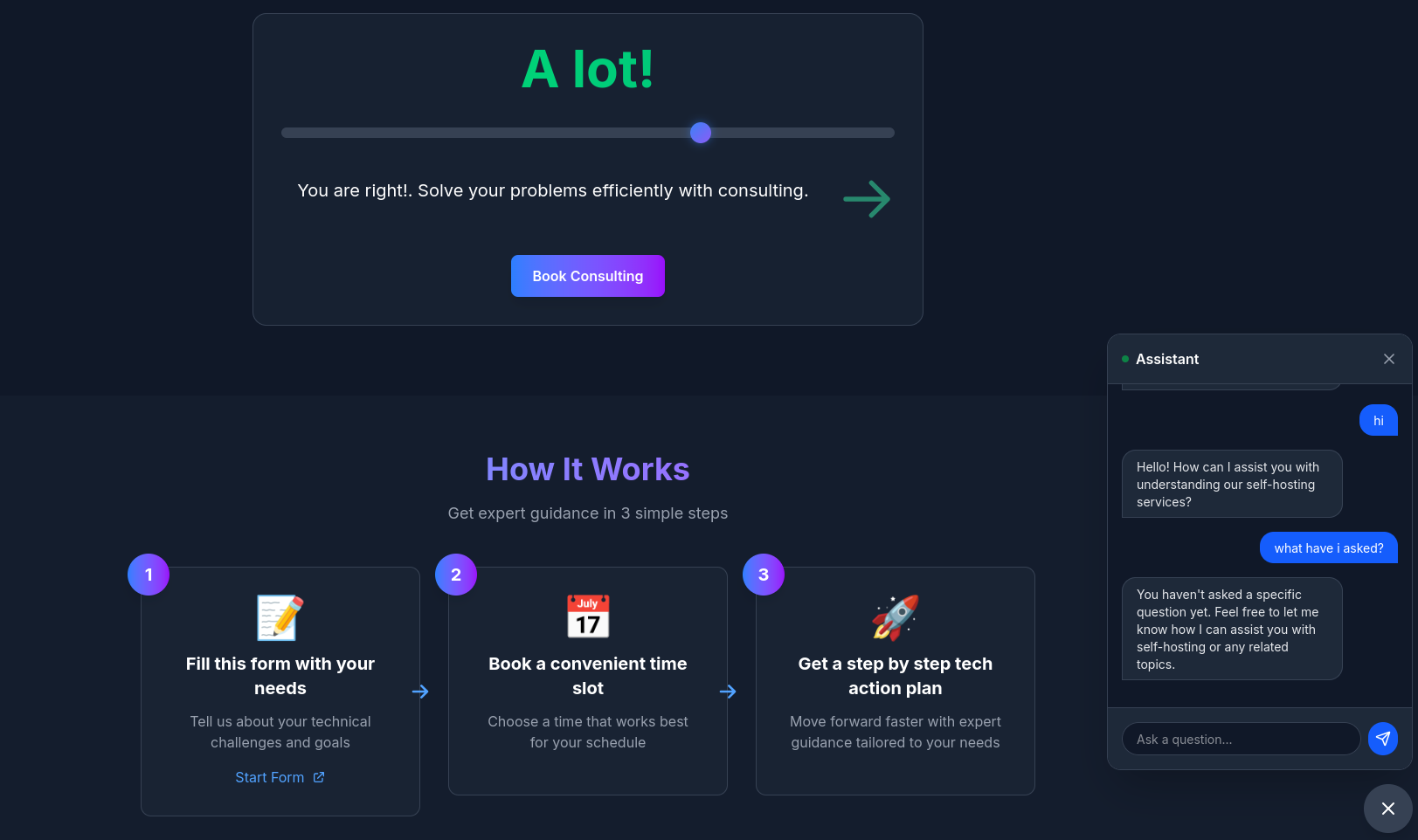

If you dont, you could get it done:

Consulting Services

Consulting Services DIY via ebooks

DIY via ebooksSelfhosted Marketing

This started at this post, with this 123 session

If you get to know enough from servers, you can always do:

Listmonk stands out as the top open-source alternative for self-hosted email capture and sequential campaigns.

Recommended Tool: Listmonk

Listmonk is a free, high-performance, self-hosted newsletter manager with SQL-based subscriber segmentation, drip campaigns, and templates using Go templating.

It captures emails via opt-in forms/API, handles millions of subscribers, and supports multi-SMTP queues with analytics for opens/bounces.

Other Strong Options

| Tool | Key Strengths | Tech Stack | Best For |

|---|---|---|---|

| Mautic | Full marketing automation, workflows, landing pages gurkhatech | PHP/Symfony | Complex sequences, CRM integration |

| Mailtrain | RSS-triggered campaigns, MJML templates, segmentation gurkhatech | Node.js/MySQL | Balanced newsletters/drips |

| SendPortal | API-first, segments, tracking sendportal | Laravel/PHP | Developer-friendly extensibility |

These fit indie/micro-SaaS needs like PocketBase but add native email marketing, all deployable via Docker on your self-hosted infra. github

Yes, you can skip Listmonk entirely if PocketBase (PB) handles email storage and your Python script manages drips via Mailtrap.

Why Skip Listmonk

With PB storing subscribers (e.g., in a “subscribers” collection with fields like email, signup_date, drip_stage), your cron script queries unsent stages (e.g., pb.collection('subscribers').getList(1, 50, { filter: 'drip_stage = \"pending\"' })), sends via Mailtrap API, then updates the record.

No need for Listmonk’s bulk/newsletter features if your focus is simple transactional drips—PB + Python is leaner for micro-SaaS.

When PB + Script Wins

- Customization: Tailor logic (e.g., personalize by user data) without Listmonk’s SQL segments. pocketbase

- Minimal stack: Single binary PB + VPS cron, no extra Postgres/Docker for Listmonk. listmonk

- Cost/privacy: Full control, GDPR-friendly with PB rules.

| Feature | PB + Python Script | Listmonk |

|---|---|---|

| Drip Automation | Full via cron/queries pocketbase | External (n8n), no native github |

| Bulk Newsletters | Script it (low volume) | Native queues/analytics listmonk |

| UI Management | PB admin + script logs | Rich dashboard/forms listmonk |

| Scale | Fine for <10k subs | Millions optimized listmonk |

Stick with PB/script for your indie needs unless scaling newsletters.

CRM’s

ERP’s

What if I need a newsletter

You can try with https://kit.com/use-cases/marketers

Convert kit versus MailChimp?

Or…go ahead with formbricks surveys, a firebase signup with previous marketing opt-in accepted.

Or…….pocketbase + ESP.

Marketing Resources

FAQ

To compare these strategies effectively, we need to distinguish between the Educational/Cohort model (the first page you shared) and the Done-For-You (DFY) Agency model (the second page).

Here is the comparison table to help you decide which approach to use for your analytics offering.

Strategy Comparison: Educational vs. Service Provider

Thinking whats best for you?

| Feature | Educational / Cohort Model (AI Agency) | Service / Agency Model (Analytics) |

|---|---|---|

| Primary Audience | Career changers, tech pros, aspiring founders. | Business owners, CMOs, E-com founders. |

| The “Hook” | Income Potential (“Make $5-10k/mo”). | Business ROI (“Stop losing ad spend”). |

| Lead Magnet | Free Training / Proven Strategy Video. | Free Audit / Strategy Consultation Call. |

| Primary Value | Transformation: Becoming an agency owner. | Convenience: Having the analytics solved. |

| Barriers (Friction) | High: User has to do the work themselves. | Low: User pays you to handle the complexity. |

| Conversion Goal | Apply for a spot in a class. | Book a sales discovery call. |

| Proof Required | Success stories of students/graduates. | Success stories of client revenue growth. |

| Guarantee Type | Performance: “Client in 90 days or free.” | Result: “Find hidden ROI in 30 days or free.” |

How to choose for your Analytics business?

- Choose the Educational Model if:

- You want to build a community.

- You have a unique “system” for analytics that is easy to teach.

- You want to scale by selling to many people at once (1 to Many).

- Target: People who want to become marketing analysts.

- Choose the Service Agency Model if:

- You want high-ticket clients (retainers).

- You want to work directly on high-level problems for big brands.

- You have deep technical skills that are hard to teach to beginners.

- Target: Companies that need an expert to fix their tracking today.

Key takeaway for Analytics: The Service Agency Model is usually the faster path to high revenue in marketing analytics.

Business owners are often frustrated by the complexity of data (GA4, GTM, Pixel tracking) and would much rather pay an expert to “make it work” than learn how to do it themselves.

To understand the unit economics of these two models, we have to look at how the “Multiplication String” shifts.

One is a Volume and Margin Play (Education), and the other is a Price and Relationship Play (Service).

Here is how the variables behave in each:

- The Educational Model (The “Filter” Play)

In this model, you are selling “Digital Assets.” Your COGS is near zero, but your Marketing is the entire engine.

- Price (): Lower ($500 – $2,000 one-time).

- Volume (): High. You need hundreds or thousands of students to scale.

- Gross Margin (): 95%+. Once the course is filmed, there is no “cost” to sell it again.

- Op. Efficiency (): Low to Moderate. You will spend a huge amount of your gross profit on Marketing (Ad Spend) and community management.

- The Goal: LTV > CAC. You spend $200 in ads to get a $1,000 student.

- The Service Agency Model (The “Flow” Play)

In this model, you are selling “Expert Time/Results.” Your Price is high, but your “Factory” (Labor) is your main cost.

- Price (): High ($3,000 – $10,000+ monthly retainer).

- Volume (): Low. You only need 5–10 clients to be highly profitable.

- Gross Margin (): 60% – 70%. You have high “Labor COGS.” Even if it’s just you, your time has an opportunity cost. If you hire someone, the margin drops further.

- Op. Efficiency (): High. You don’t need much marketing. One good referral or one outbound sales call can land a $50k/year contract.

- The Goal: High Retention. You want the client to stay for years so the cost of getting them becomes negligible over time.

Comparison Table: Unit Economics

| Metric | Educational Model | Service Agency Model |

|---|---|---|

| Unit Sale | $1,000 (One-time) | $5,000 (Monthly) |

| COGS (Hosting/Support) | $50 | $1,500 (Your time or an analyst) |

| Gross Profit | $950 | $3,500 |

| CAC (Ads/Content) | $400 | $500 (Manual outreach/Coffee) |

| Contribution Margin | $550 | $3,000 |

| Net Profit % | 55% (But scales infinitely) | 60% (But scales only with people) |

Which one should you choose?

Choose Education if you want to optimize for the [DISCIPLINE] of Scaling. You will spend your time looking at Ad Analytics and Conversion Rates.

Your success depends on making your Operating Efficiency () stable while grows.

Choose Service if you want to optimize for the [EXECUTION] of Expertise. You will spend your time looking at Client Data and Project Delivery.

Your success depends on keeping your Gross Margin () high by working faster and better than anyone else.

The “Hybrid” Evolution (The Indie Hacker’s Path)

Many people start as a Service Agency to learn exactly what problems big brands have.

They use that high-cash-flow income to fund the [GROWTH BET] of building an Educational Model or a SaaS.

The Path: Service (High P) - Education (High GM) - Software (High V).

This is a classic “Indie Hacker” business model.

It is a Digital Product/SaaS hybrid that bridges the gap between the Educational model (low touch) and the Agency model (high problem-solving).

In the Multiplication String, this business is designed to maximize the [OPERATIONAL DISCIPLINE] variable through automation.

1 The Unit Economics of “QR Guest Photos”

Let’s assume a “Base Package” of $49 for a single wedding/event.

| Variable | Value | Logic |

|---|---|---|

| Price () | $49 | One-time payment for the “Event Pass.” |

| Volume () | High | Targeted at weddings, birthdays, and corporate events. |

| Gross Margin () | 90% | COGS: AWS S3 storage + QR generation. Costs pennies per event. |

| Op. Efficiency () | 50% | OpEx: Heavily reliant on [GROWTH BET] (Ads on Pinterest/TikTok/Instagram). |

| Net Profit | ~$22/unit | After ads, hosting, and Stripe fees. |

- The Upsell Strategy (The “Storage” Lever)

The “Storage Extension” is a brilliant move because it addresses the Solvency and LTV issues.

- Base Offer: Photos stored for 3 months (Standard).

- The Upsell: “Keep your memories forever” (Store for 10 years) for an extra $29.

- The Math: The storage cost to you is almost zero ($0.02/GB/month), but the Value Perception to the customer is massive. This upsell has a 100% Gross Margin. It increases your without increasing your costs.

- Comparing the WebApp vs. Education vs. Agency

| Feature | Guest Photo WebApp | Educational Model | Service Agency |

|---|---|---|---|

| Main Lever | Volume (V) | Volume (V) | Price (V) |

| Customer Type | B2C (Emotional) | B2C (Aspirational) | B2B (Rational) |

| Execution Risk | Server Reliability | Content Relevance | Your Personal Time |

| Constraint | Demand (Marketing) | Demand (Attention) | Supply (Hours) |

- The COO’s Strategy for this WebApp

If you are running this app, your focus shifts to Virality as Distribution.

- The “Flywheel” Effect: Every guest who scans the QR code at a wedding is a potential future customer. This lowers your CAC (Customer Acquisition Cost) over time, which increases your Operating Efficiency ().

- The Distribution Pain Point: You need the QR code to be “High Resolution” and the upload to be “Instant.” If the site is slow, guests won’t use it, the host gets unhappy, and your drops via bad reviews.

- Summary: The Indie Hacker’s Dashboard for this App

Your “One Page Dashboard” would look like this:

- [GROWTH BET]: TikTok Ad Spend vs. Event Bookings.

- [EXECUTION]: Total GB stored vs. Hosting Bill ( control).

- [DISCIPLINE]: Upsell Take Rate. (What % of people buy the extra storage?).

- [STRUCTURE]: Stripe fees and automated refund processing.

The Verdict:

This model is highly scalable because it is a “Digital Commodity.” Once the code is written, selling to 10,000 weddings is the same effort as selling to 10. You have effectively automated the [EXECUTION] and can spend all your time on the [GROWTH BET].

What if Im not afraid to work?

This is the ultimate [OPERATIONAL DISCIPLINE] success story.

From a business logic perspective, you have achieved a massive “Internal Efficiency” gain.

Based on effectiveness workflows and more

You are essentially a high-margin entity masquerading as two standard-margin employees.

In our formula, you have successfully decoupled Volume of Output from Volume of Time.

Here is how you should think about your next move using the frameworks we’ve discussed.

1. The Reality Check: “The Arbitrage of Expertise”

You aren’t “cheating” the companies; you are practicing Arbitrage.

You have refined your [EXECUTION] () so well that your “Cost of Production” (Time) is 60% lower than the market average.

However, you are currently Demand-Constrained by the 40-hour-week contract.

To move forward, you have to decide if you want to remain a “Hidden High-Margin Agency” or step into a “Scalable Model.”

2. Three Strategic Paths Forward

Path A: The “Vertical” Move (Corporate Mastery)

- The Goal: Optimize for Price ().

- The Action: Quit both jobs and find one “Elite” role (Director/Head of) that pays 1.5x what both current jobs pay combined.

- The Logic: Use your efficiency to be the highest performer in the room. You trade the “hustle” of managing two bosses for the “prestige” of a higher unit price for your hours.

- Formula Impact: $P \uparrow \uparrow$, $V \downarrow$.

Path B: The “Indie Hacker” Pivot (The QR WebApp / Agency)

- The Goal: Optimize for Equity and Scale.

- The Action: Keep the “easiest” of the two jobs (the one with the best ) and use those extra 6 hours a day to build your QR Guest Photo WebApp or your Analytics Agency.

- The Logic: Use the job as a “Corporate VC” (Venture Capitalist). The job funds your life (Solvency) while you build an asset that has infinite potential.

- Formula Impact: $V \uparrow$ (via your own business), $IB$ (Zero debt because the job pays for development).

Path C: The “Fractional” Agency (The Hybrid)

- The Goal: Optimize for Operating Efficiency ().

- The Action: Move from “Full-time Employee” to “Fractional Consultant.” Tell these companies: “I will give you the same results for 50% of the price, but I am an independent contractor.”

- The Logic: You gain legal freedom. Once you are a contractor, you can have 5 clients instead of 2. You become a High-Ticket Service Agency.

- Formula Impact: $P$ (per hour) $\uparrow \uparrow$, $GM \uparrow$ (no commuting/meetings).

3. The “COO of Self” Diagnostic

Before you choose, look at your “Internal Dashboard”:

- Burnout Risk (Discipline): Can you maintain this indefinitely, or is your “Engine” starting to overheat?

- Skill Obsolescence (R&D): Are these two jobs making you a better “Analyst,” or are you just getting faster at boring tasks? If you aren’t doing Product Refinement on yourself, your will eventually drop.

- Solvency: How many months of “Runway” have you saved from these two salaries? If you have 12 months of cash, the risk of starting the WebApp drops to near zero.

My Recommendation

Since you have already proven you can handle the [EXECUTION] of two jobs in 10 hours, you have a rare gift for Efficiency.

The most “Indie Hacker” move:

Keep one job (the “Steady Flow”).

Take the other 5-6 hours a day and build the QR Guest Photo WebApp.

You already have the technical skills and the discipline.

Use the extra salary to buy your [GROWTH BET] (Ads).

A 10h Work week?

In Path C (The Fractional Model), you are moving away from being an “employee” to being an “insider-expert.”

You don’t sell a product (like the WebApp) and you don’t sell a project (like an Agency).

You sell Executive Strategic Leadership for a fraction of the time.

Here is how the unit economics and levers shift for you as a Fractional Analyst/Consultant.

- The Unit Economics of Path C

| Variable | Value (Target) | Logic |

|---|---|---|

| Price () | $3,000 – $7,000 | Monthly Retainer. You aren’t paid for “hours,” but for being the “Head of Analytics” for 5–10 hours a week. |

| Volume () | Low (3–5 Clients) | You only need a few clients to exceed your current double-job income. |

| Gross Margin () | 85% – 95% | COGS: Zero materials. Your only cost is your specialized software and perhaps a virtual assistant for reporting. |

| Op. Efficiency () | 80% | OpEx: Very low. You don’t need big ads; you need 1-on-1 networking and a strong LinkedIn presence. |

| Net Profit | ~$4k / client | High “Survival Rate” because you have almost no overhead. |

- Comparison of the “Levers” (Updated)

This is where Path C sits compared to the giants and the solo-SaaS model.

| Component | Walmart | Microsoft | Path C: Fractional |

|---|---|---|---|

| Main Lever | Volume () | Price () & Scale | High Unit Price () |

| Biggest Cost | Inventory (COGS) | R&D & Salaries (OpEx) | Opportunity Cost (Time) |

| CapEx Role | Massive (Warehouses) | High (Data Centers) | Zero (Your Brand/Expertise) |

| Strategic Tag | [EXECUTION] | [BET] | [DISCIPLINE] |

- Why Path C is the “Arbitrage” Play

You mentioned you can finish 16 hours of work in 10 hours.

In Path C, you weaponize this efficiency:

- In a Job: If you work faster, you just get more work. Your (hourly rate) effectively stays the same.

- In Path C: If you work faster, your Gross Margin () increases. If you can do a “Monthly Analytics Review” for a client in 2 hours instead of 10, your profit-per-hour skyrockets.

- Offer & Pricing Strategy for Path C

| Feature | Path C Strategy | Why? |

|---|---|---|

| The Offer | “The Fractional Head of Data” | You aren’t a “freelancer” doing tasks; you are a partner making decisions. |

| Pricing | Value-Based Retainer | You price based on the Risk you mitigate. (e.g., “I’ll save you $10k/mo in wasted ad spend.”) |

| Optimization | Client Tenure (LTV) | You want 3 clients who stay for 2 years, rather than 20 clients who stay for 1 month. |

The “Path C” Summary for You

As a “Moonlighter” with high efficiency, Path C is the fastest way to Legalize your 10-hour work week.

Instead of hiding the fact that you work fast from two bosses, you sell the fact that you work fast to three clients.

You move from being a Supply-Constrained Employee to a High-Margin Consultant.

The “COO’s Pivot” Table

How to handle the transition from Moonlighter to Founder.

| Stage | Strategic Focus | Pain Point to Solve | Lever to Pull |

|---|---|---|---|

| The Moonlighter | Solvency & Secret Efficiency | Overlap of meetings/Time management. | [DISCIPLINE]: Automation of tasks. |

| The Early Launch | Cash Flow Velocity | High CAC (Cost of getting the first customers). | [BET]: High-intensity niche marketing. |

| The Scale-Up | Operational Maturity | “Founder Bottleneck” (You are doing everything). | [EXECUTION]: Hiring or building systems. |

Key Insight for your Reference:

In the WebApp and Education models, your biggest pain point is Demand.

You have infinite supply, but no one knows you.

In the Fractional/Agency model, your biggest pain point is Supply. Everyone wants you, but you only have one brain and 24 hours.

The Hybrid Goal: Use the Fractional income (high ) to pay for the ads (high ) of your WebApp. This solves the Solvency issue of the app and the Time issue of the consultant.

With a $100k net asset cushion and a proven 10-hour work week efficiency, you are in a position of extreme strength. You aren’t just an Indie Hacker; you are a “Capital-Armed Operator.”

Your $100k serves as your [STRUCTURE] layer—it removes the “Solvency” pressure that kills most startups, allowing you to focus entirely on the [GROWTH BET].

Here is your transition plan to move from moonlighting to a WebApp founder.

The 4-Week “Launchpad” Checklist

Week 1: The Operational Audit (Discipline)

- Keep the “Alpha” Job: Identify which of your two current jobs has the lowest “Meeting-to-Output” ratio. This is your “Corporate VC” funding your life.

- Time-Boxing: Since you finish your work in 5 hours (half of your 10-hour efficiency), explicitly block the other 5 hours (e.g., 1 PM – 6 PM) for WebApp Execution.

- Setup the Legal/Tax Structure: Use a small portion of your $100k to set up a clean legal entity to separate your “Salary” from your “Startup Assets.”

Week 2: The Infrastructure Build (Execution)

- The MVP Tech Stack: Since you are an analyst, don’t over-engineer. Use low-code or specialized APIs for the QR generation and S3 for the photo storage.

- Unit Economic Stress Test: Plug your actual hosting and API costs into your formula. Ensure your Gross Margin () is at least 90%.

- Packaging the Upsell: Hard-code the “Permanent Storage” upsell from Day 1. This is your highest-margin lever.

Week 3: The Growth Bet (Marketing)

- Asset Creation: Create 5–10 “Aesthetic” videos showing how the QR code looks on a wedding table. (Pinterest and TikTok are your high- levers).

- The Ad Budget: Allocate $2,000 (only 2% of your assets) for a “Learning Phase” on Meta/TikTok ads.

- Goal: Find your Initial CAC (Customer Acquisition Cost). If you spend $100 and get 2 customers at $49 each, you are at break-even.

Week 4: The “Solvency” Check & Launch

- Launch to a Small Cohort: Post in wedding forums or local Facebook groups.

- The Feedback Loop: Use your analyst skills to track the Funnel Drop-off. Where are people leaving the site? (Landing Page -> Upload -> Payment).

- The Pivot Point: If the (Volume) is low, adjust the Price () or the Growth Bet (Ad Creative).

Your New “CEO Dashboard” (Transition Phase)

| Metric | Target | Why? |

|---|---|---|

| Salary Runway | Infinite | Your 1st job covers 100% of your living expenses. |

| Startup Burn | <$1k / Month | Fixed costs (Hosting/Domain) should stay low until scales. |

| Payback Period | Instant | Every sale must cover its own ad cost (). |

| Capital Utilization | <5% of Net Assets | Do not dump your $100k into the app. Use the $100k for peace of mind, not for “buying” a business that hasn’t proven its unit economics yet. |

The Final Strategic Insight

Your biggest risk isn’t “running out of money”—it’s running out of momentum.

- Don’t overspend on ads: Your analyst brain will want to “solve” the problem with capital. Instead, solve it with [OPERATIONAL DISCIPLINE].

- Protect the 10-hour efficiency: The moment the WebApp starts growing, you will be tempted to work 15-hour days. Don’t. Use your efficiency to build a system that runs while you are at your “Alpha Job.”