Crypto. Now understandable with AI

Tl;DR

Consolidating crypto resources and how to understand them better with LLMs.

+++ Playing with Defi protocols and tokens like USDT

Nobody knows what will be BTC dominance, but this is going on with ,digital usds'

Intro

Here we go again…

Since last year, crypto seems to be back again.

For some in reddit, crypto has been there for some time.

Now, it seems that some big corporations are buying.

There are those who talk about a 21btc dream, which todays sounds unreachable.

Few, say that all this thing comes from the wtf1971 trend

Others, even dare to model the future, like with a stock to model to predict the price: see this and this

Recently I was writing about hashing and encryption tools here

What I want to cover here:

- Crypto 101 Analytics with Dune and a look to PolyMarket

- Crypto Resources to explore further some concepts: dex, lending

- Skin in the game: testing some DeFi protocols to understand them better

- A remind of the crypto TRILEMA

Whatever project you will look, understand where it falls inside the TRILEMA

The “crypto trilemma,” also known as the blockchain trilemma, is a concept that was popularized by Ethereum co-founder Vitalik Buterin.

It posits that it is extremely difficult for a decentralized network to simultaneously achieve three key properties:

Decentralization: The network’s control and decision-making power are distributed among a large number of participants, rather than being held by a single entity or a small group. This is the core principle of blockchain technology, making it censorship-resistant and transparent.

Scalability: The network’s ability to handle a large number of transactions quickly and efficiently. For a blockchain to be widely adopted, it needs to process transactions at a speed comparable to traditional payment systems like Visa or Mastercard.

Security: The network’s ability to resist attacks and manipulation. This is essential for protecting user funds and ensuring the integrity of the ledger.

The Trade-off

The “trilemma” suggests that a blockchain can only effectively optimize for two of these three properties at a time, and must sacrifice the third to some degree.

Decentralization + Security: This is the path taken by blockchains like Bitcoin. It is highly decentralized and incredibly secure, but it is not scalable. It can only handle a limited number of transactions per second, which leads to slow transaction times and high fees during periods of network congestion.

Scalability + Security: Some projects may choose this path by using a more centralized consensus mechanism (e.g., Proof-of-Authority). By limiting the number of validators, they can achieve high transaction speeds and maintain security, but they compromise on decentralization.

Decentralization + Scalability: This is arguably the most difficult and least common combination to achieve. Some early projects attempting this have faced security vulnerabilities. A decentralized network with high transaction speeds could be more susceptible to attack.

The Search for a Solution

The blockchain trilemma is the fundamental challenge driving much of the innovation in the crypto space. Developers are working on various solutions to overcome this trade-off, including:

- Layer 2 Solutions: These are protocols built on top of a main blockchain (like Ethereum) to handle transactions off-chain before settling them on the main network. Examples include Rollups (zk-rollups and optimistic rollups), which bundle transactions together to increase throughput while still leveraging the main chain’s security.

- Sharding: This involves dividing a blockchain into smaller, parallel sub-chains (shards) that can process transactions simultaneously. This allows the network to handle more transactions without requiring every node to process every single one.

- New Consensus Mechanisms: Some new chains are exploring different consensus mechanisms beyond Proof-of-Work (PoW) and Proof-of-Stake (PoS) to find a better balance of the three properties.

And thanks to LLMs, you can quickly understand the trade-offs of any project.

Because everytime that you will open DefiLlama, there will be many more acronyms.

The blockchain trilemma provides a useful framework for understanding the design choices and trade-offs made by different networks. Here’s a breakdown of where Monero, Ripple, and Solana typically sit in this model:

Monero (XMR)

- Position: Monero prioritizes Decentralization and Security, similar to Bitcoin. It’s a privacy-focused cryptocurrency, so its core mission is to be censorship-resistant and tamper-proof.

- Decentralization: Monero has a strong focus on decentralization. It uses a different Proof-of-Work (PoW) algorithm (RandomX) that is designed to be ASIC-resistant. This allows anyone to mine XMR using a regular computer’s CPU, which helps to distribute mining power more widely and prevents the centralization of power in large, specialized mining farms.

- Security: As a PoW network, Monero’s security is derived from the collective computational power of its miners. The privacy features, such as ring signatures and stealth addresses, add a layer of cryptographic security that makes transactions unlinkable and untraceable.

- Scalability: Monero’s scalability is limited, similar to other PoW blockchains. Its block time is relatively slow, and transaction fees can increase during times of high demand. However, Monero’s developers have implemented a “tail emission” to ensure a perpetual incentive for miners to secure the network, which is a long-term solution to security that prioritizes decentralization over a fixed supply.

Ripple (XRP)

- Position: Ripple (and its native asset, XRP) leans heavily towards Scalability and Security, while making a notable trade-off in Decentralization.

- Scalability: The XRP Ledger is built for speed and low cost, capable of processing transactions in seconds. It achieves this by not using a traditional PoW or PoS mechanism. Instead, it uses a unique consensus protocol known as the Federated Consensus model. This is its key value proposition, designed for high-volume, low-cost financial transactions.

- Security: The network is secured by a set of trusted validators that are collectively agreed upon. For a transaction to be confirmed, a supermajority of these validators must agree. This model provides high security and fast finality for transactions.

- Decentralization: This is where Ripple is often criticized. The network is maintained by a pre-selected list of validators, known as the Unique Node List (UNL). While anyone can run a validator, the fact that a small group of entities—including Ripple Labs—initially controlled the “trusted” list means it’s not as decentralized as open, permissionless networks like Bitcoin or Ethereum. This approach sacrifices some decentralization for the sake of speed and efficiency.

Solana (SOL)

- Position: Solana is designed to solve the trilemma by prioritizing Scalability and Security, with its decentralization being a subject of ongoing debate.

- Scalability: Solana’s primary selling point is its impressive speed and low transaction costs. It achieves this through a novel combination of a Proof-of-Stake (PoS) consensus mechanism and a new technology called Proof of History (PoH). PoH is essentially a verifiable timekeeping mechanism that allows validators to process transactions in parallel, which is what enables its high throughput.

- Security: The network’s security is tied to its PoS mechanism, where validators stake their SOL tokens to secure the network. The financial incentive to be an honest validator and the cryptographic security of the protocol provide robust security. However, due to its high throughput, Solana has experienced several network outages, which have raised questions about its reliability and long-term security.

- Decentralization: This is the most contested part of Solana’s position. The high hardware requirements and the significant stake needed to run a validator make it more difficult for the average person to participate, which can lead to a more centralized network of large validators. While there is a large number of validators, the high costs of participation and a history of network outages are often cited by critics as a sign of its lack of true decentralization.

What this post is NOT about: a solidity 101, neither financial advice of any type.

Despite that, some time ago I was having a look to this amazing BlockChain/Solidity FreeCodeCamp course:

And this can be much easier thanks to vibe coding!

Practical Blockchain:

- Parties that do not know each other can exchange value without a central authority

What would Cicero Think about Crypto? About Rules and Tyranny

- Protection Against Arbitrary Power

Cicero’s View:

- Clear, consistent laws safeguard against tyranny or arbitrary rule.

- Without laws, society is governed by the whims of those in power, leaving people without protection or fairness.

Complexity’s Role:

- A well-designed system of rules provides structure and predictability.

- Everyone—whether ruler or citizen—is theoretically bound by these rules, leveling the playing field and reducing the ability of any one person or group to impose their will unfairly.

- Risk of Over-Regulation or Tyranny of Rules

Too Many Rules:

- Excessively complex systems can result in over-regulation.

- People may struggle to navigate the legal or bureaucratic framework, hindering personal freedoms.

- Complex rules can concentrate power among those who manipulate or interpret the system.

Inaccessibility:

- Complex rules create a divide between those who understand the law (experts, bureaucrats, the wealthy) and the general population.

- Individuals may feel oppressed or disadvantaged without the resources to navigate or challenge the system.

If there are no clear laws, we will be enslaved by the wishes of men - Cicero

My point is: I dont have any idea about Solidity, Smart Contracts or whatever code goberns crypto.

But…I think many of us know how to use AI already (particularly LLMs) - to get some ideas of what are we interacting with.

Let’s try to get clarification on some Smart Contract

Understanding SC’s with LLMs: these are are some interesting protocols as per dappradar

More protocols…Lido, yearn, compound… 🚀

https://lido.fi/ - Decentralized Staking ETH (get stETH and use stETH in DeFi)

Crypto Analytics

There are of course some platforms already for this.

But as this is all public, how about…exploring a BTC wallet?

Like the one offered for donations at duckdns:

I guess they follow some kind of hodlhodl approach to keep pocketbitcoin via relai.

And that exploration of a wallet can be done with Python!

Crypto - SelfServing Dashboards & Analytics Platforms: Dune and more 📌

I have used Dune-Analytics, together with SQL

DeBank:

- Free Tier: DeBank offers a free version that includes basic features for tracking and managing decentralized finance (DeFi) portfolios, such as token balances, transaction histories, and portfolio insights across multiple chains.

- Usage: Popular among users for its clean, easy-to-use interface and chain aggregation features.

Zapper:

- Free Tier: Zapper provides free access to basic DeFi portfolio tracking and yield farming analytics. It aggregates data from various DeFi protocols and presents it in a unified dashboardsage**: A favorite for users tracking multiple DeFi investments across different platforms, with an intuitive user interface.

Nansen:

- Free Tier: The free version of Nansen offers basic tracking features but with significant limitations, including access to limited data on wallet activity and DeFi protocols .

- Advanced features, such as more detailed analytics, deeper insights into DeFi protocols, and enhanced filtering, are available through paid plans.

Dune Analytics:

- Free Tier: Dune offers a free version that allows users to query and visualize blockchain data using SQL. However, query limits and access to certain advanced dashboards are restricted .

- Paid Features plans unlock higher query limits, private dashboards, and greater customization options for advanced users, particularly useful for researchers and developers.

Messari:

- Free Tier: Messari’s free tier provides limited access to crypto data and analysis, such as basic market insights and some reports .

- Paid Features: Forled research, advanced analytics, and exclusive reports, Messari offers premium subscriptions. These are typically used by institutional investors and analysts.

- Nansen and Messari are particularly popular among institutional investors due to their advanced data features and research reports.

- DeBank and Zapper are favored by DeFi enthusiasts for their user-friendly interfaces and portfolio tracking capabilities.

- Dune Analytics appeals to data-driven users and developers, especially those who are comfortable with SQL and need deep access to blockchain data.

For many casual users, DeBank and Zapper provide sufficient features, while Nansen and Messari are more suited for power users needing professional-grade analysis.

Exploring Protocols

Solidity is not the only language you can use with Polygon.

While it’s the most popular language for developing smart contracts on Polygon due to its compatibility with the Ethereum Virtual Machine (EVM), other languages can be used indirectly.

Here are some other options - Vyper and Yul 📌

Indirectly through Compilation:

- Vyper: A Python-like language that compiles to EVM bytecode, allowing you to write smart contracts in a more Pythonic style.

- Yul: A low-level assembly language for the EVM, which can be used for highly optimized or specific use cases.

So if the Analytics part is clear…

…and blockchain data is public?

How about exploring one protocol as an example?

Let’s give it a try to PolyMarket

PolyMarket

Its kind of a prediction market…place? Lets find out how many transactions are happening

Polymarket Overview: A decentralized application on the Polygon blockchain for predicting real-world events like elections, interest rate cuts, sports….

About PolyMarket… 📌

Functionality: Users buy shares based on their predictions; share prices fluctuate with user confidence. Correct predictions yield profits, while incorrect ones result in losses.

Prediction Examples: Includes political outcomes (e.g., presidential elections) and pop culture events (e.g., TikTok’s potential ban in the U.S.).

Liquidity Providers: Essential for market function; they deposit funds into a share pool and earn rewards, including weekly payouts in USDC.

Important Considerations:

- Not available in the U.S.; users should verify local laws.

- Distinction between actual probabilities and market opinions is crucial.

Key Takeaways:

- Users can profit from accurate predictions.

- Liquidity providers ensure market efficiency.

- Awareness of local regulations is necessary before participation.

People have created what?

The Code - BlockChain Transaction Analyzer

How about taking the best of 2 worlds?

Lets use AI (LLMs and vibe coding techniques) to see how good are they at understanding the code of some public DeFi Protocols.

Because…why not!

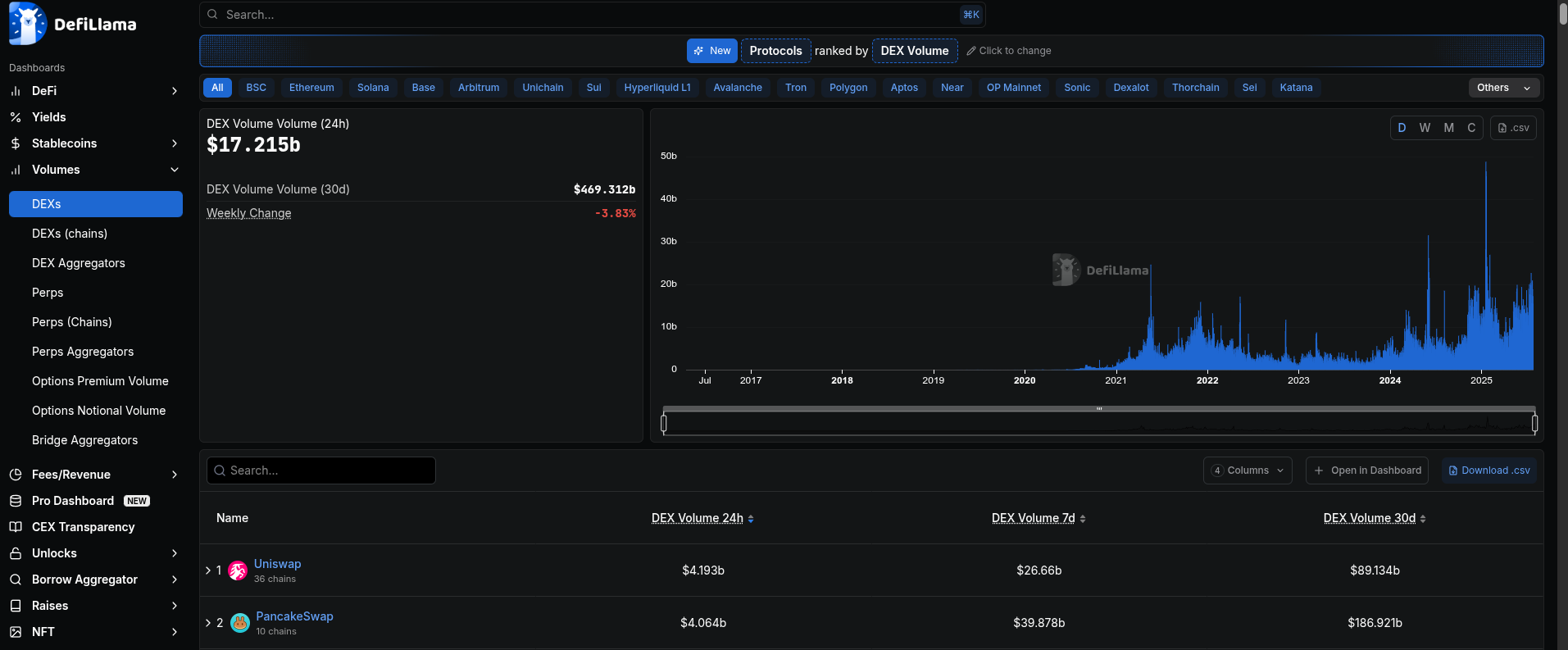

Crypto Resources

- BlockChain Scanners:

MIT | Database-free, self-hosted Bitcoin explorer, via RPC to Bitcoin Core.

Blockchain explorer for Ethereum based network and a tool for inspecting and analyzing EVM based blockchains.

- https://github.com/blockscout/blockscout

- https://defillama.com

- https://dappradar.com/rankings/defi

- https://dune.com

- See what you have in your defi wallet: https://app.metalend.tech/

See how the chaotic market is doing:

If you are having a business and want to set crypto payment

You can have a look to https://btcpayserver.org/

MIT | Accept Bitcoin payments. Free, open-source & self-hosted, Bitcoin payment processor.

Others, are exchanging it via P2P with tools like RoboStats that can be installed in few ways, like with UmbrelOS.

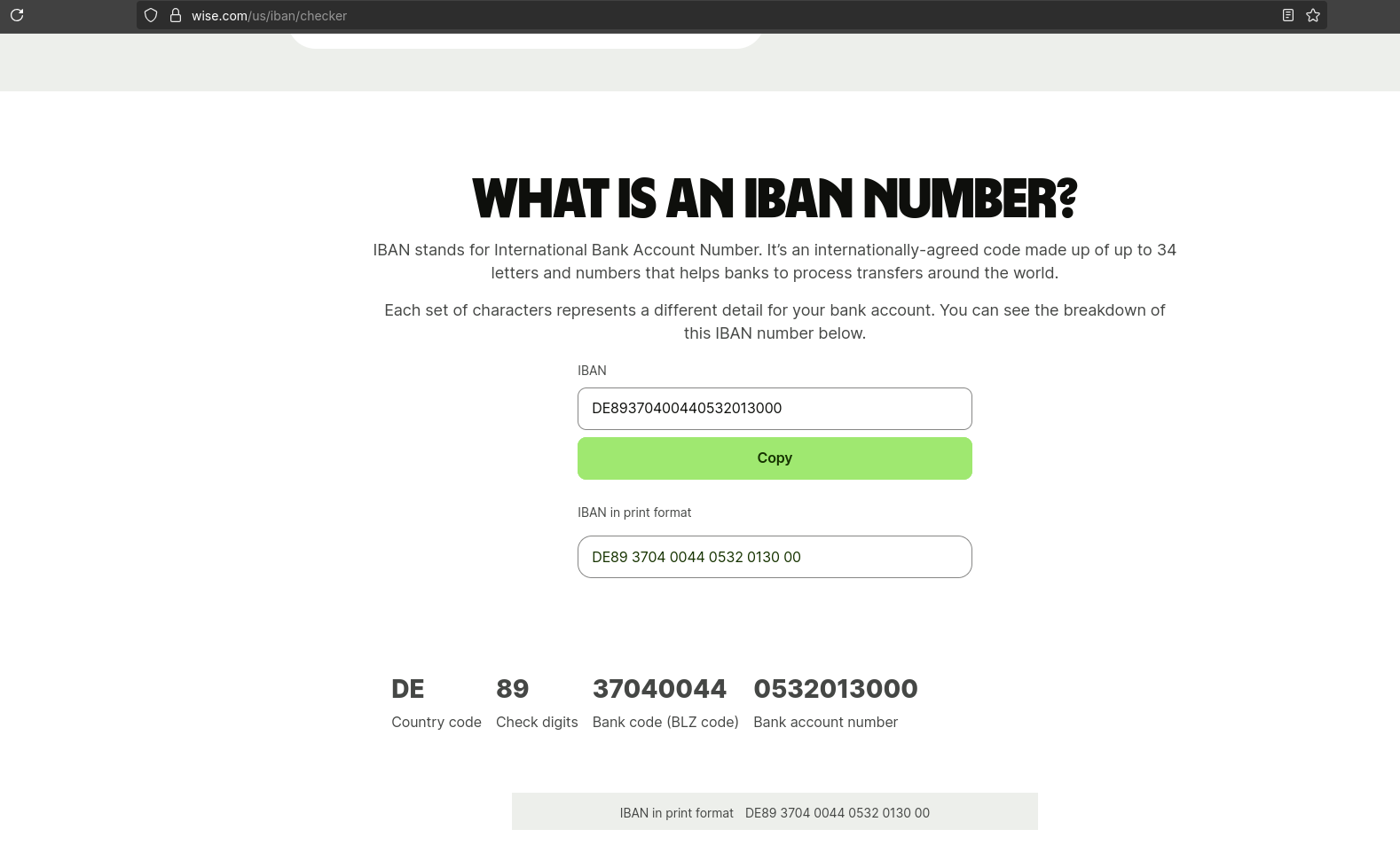

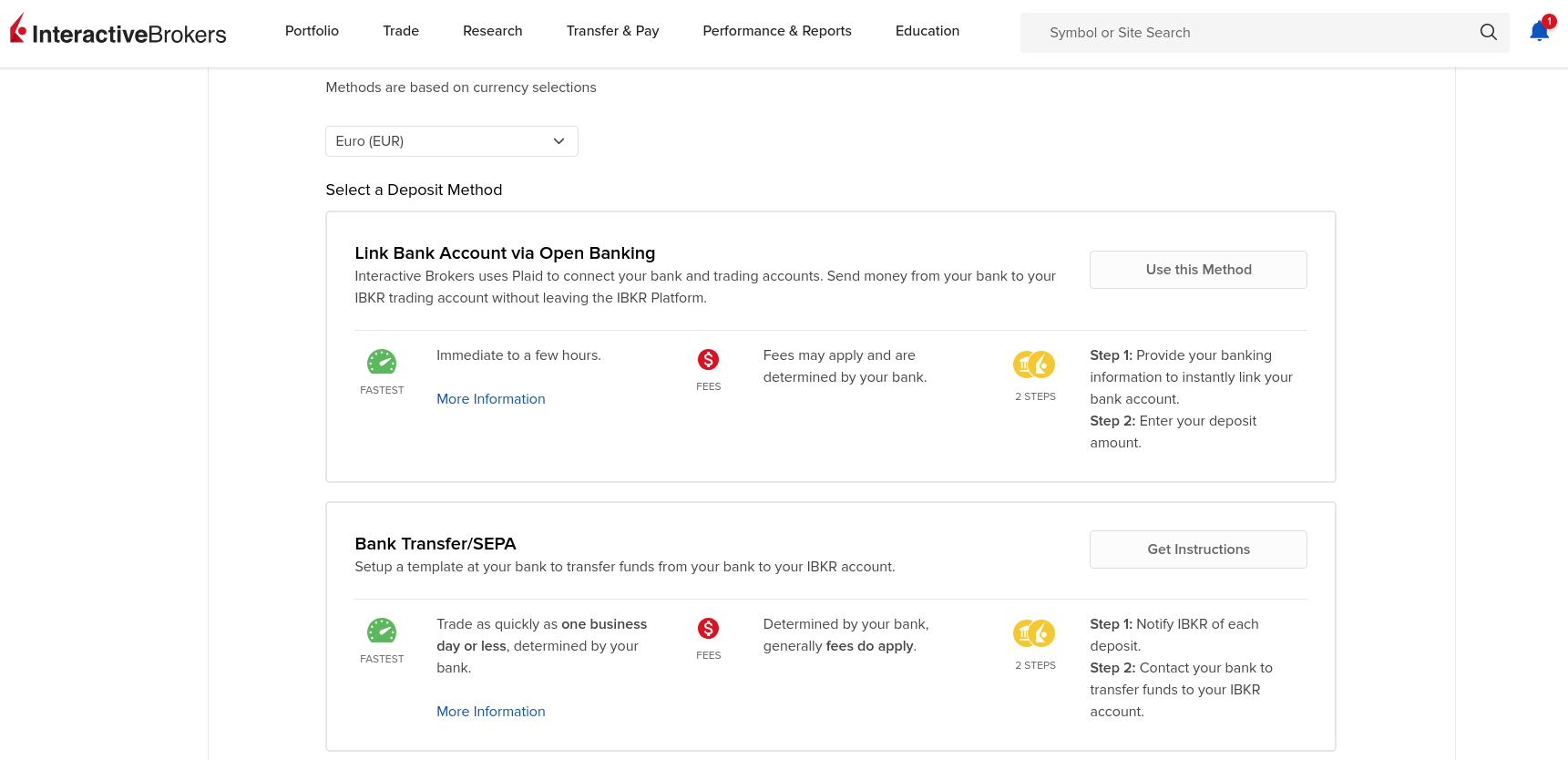

Because tradfi, and bank accounts, IBAN, BIC, SWIFTs, SEPA…

Are concepts completely another world:

But there are some open and API parts, like: Open Banking

In tradfi, you can add TCP (trusted contact persons), for crypto, im not aware of it

Interesting Crypto Stuff I found lately

More Web3 Stuff?

Because…somehow this links to crypto.

I was writing about web3 here.

I was testing Astro Bento Portfolio + Github Pages + Github CI/CD with the resulting Web3/Crypto related microblog here.

https://www.reddit.com/r/defi/comments/1dl9ecu/most_reputable_respected_and_definitive_guides_on/

Full-Stack DApp Boilerplate for Substrate and ink! Smart Contracts https://github.com/scio-labs/inkathon?ref=statichunt.com

Top Protocols per Chain (for example Ethereum) - https://defillama.com/top-protocols

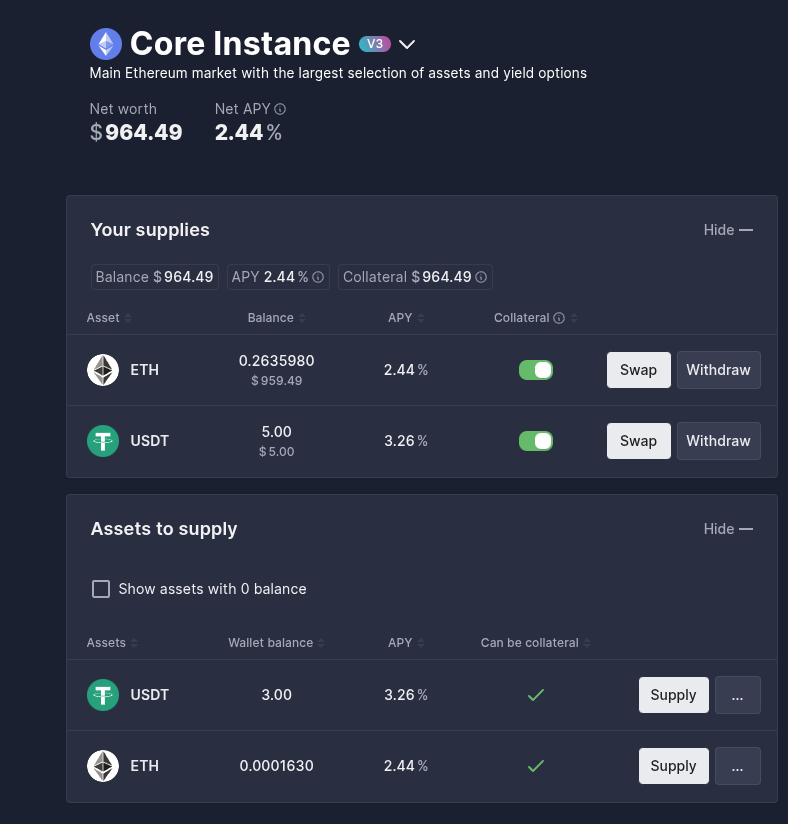

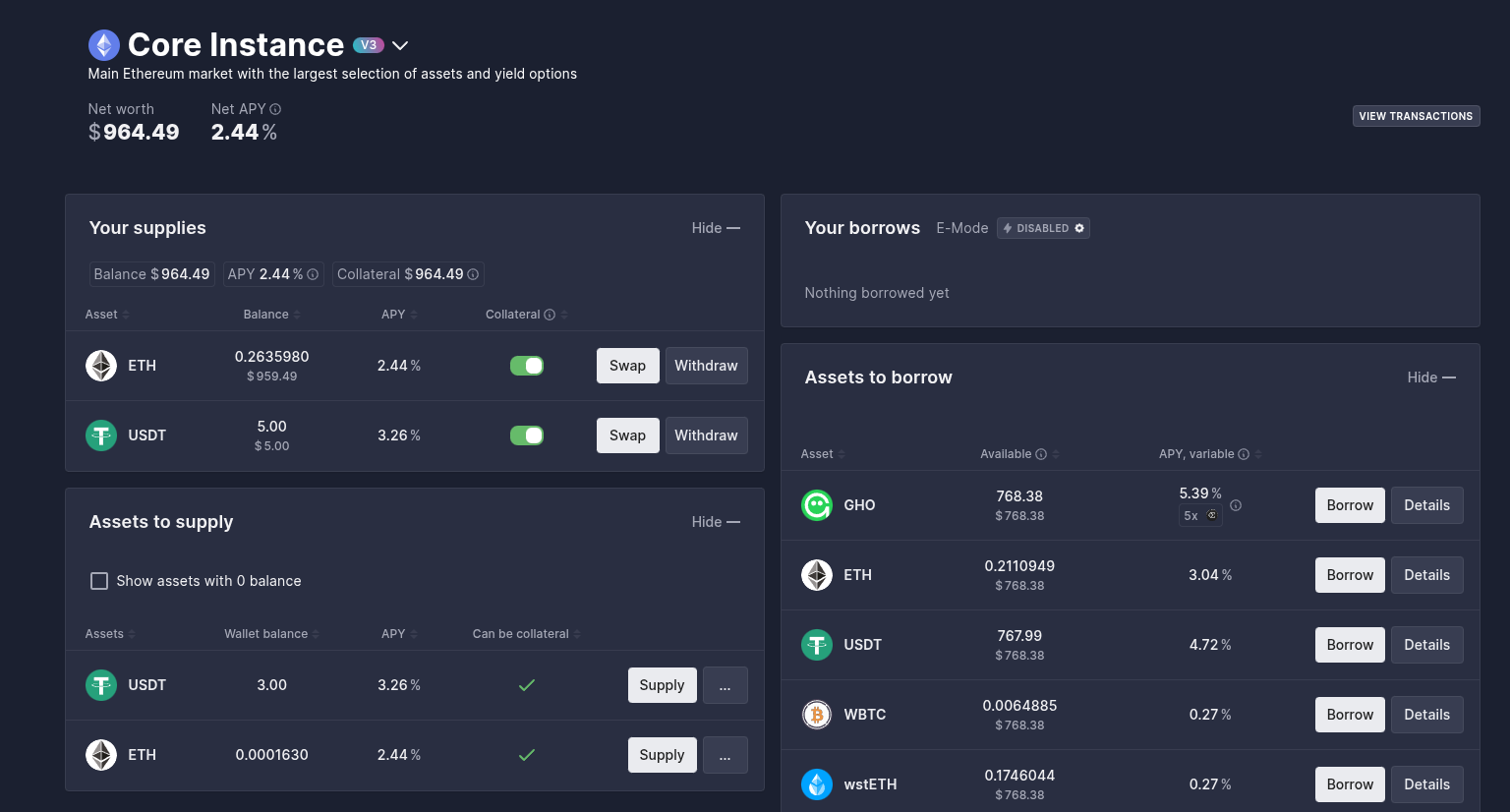

AAVE v3 is the most popular lending protocol for ETH at this moment - https://defillama.com/protocol/aave-v3?medianApy=true

Lending Protocols

I mean Lending&Borrowing Protocols: *which I could not resist to try on these examples

I got some interesting ideas from about them at:

- https://www.reddit.com/r/CryptoCurrency/comments/mnzv1c/defi_explained_lending_borrowing/

- https://www.reddit.com/r/CryptoCurrency/comments/nletmi/defi_explained_the_full_guide/#:~:text=Decentralized%20Finance%20(DeFi)%20is%20a,protocols%20that%20work%20without%20intermediaries.

I was always confused by staking vs lending, but here is the difference

DEX AMM

DEX are the defi counterparts of CEX like binance, OKX…

You will hear about quickswap (also uniswap as is very popular into the ETH network) for exchanging tokens pairs.

QuickSwap falls primarily under the category of a Decentralized Exchange (DEX) and, more specifically, an Automated Market Maker (AMM).

- https://docs.quickswap.exchange/technical-reference/core-concepts/pools

- https://quickswap.exchange/

- See some sample pools: https://dapp.quickswap.exchange/farm/0xefFA9E5e63ba18160Ee26BdA56b42F3368719615

QuickSwap is famously a fork of Uniswap, meaning its foundational code is derived from Uniswap’s open-source code.

Uniswap vs Quickswap… 🚀

QuickSwap’s Category:

- Decentralized Exchange (DEX): This means it’s a peer-to-peer marketplace where cryptocurrency transactions occur directly between crypto traders, without the need for a centralized intermediary (like Binance or Coinbase). Users maintain custody of their funds in their own wallets.

- Automated Market Maker (AMM): Instead of an order book (where buyers and sellers place specific orders), QuickSwap (like Uniswap) uses liquidity pools and algorithms to facilitate trades. Users trade against these pools of tokens.

- Layer 2 DEX: This is a crucial distinction. QuickSwap is built on the Polygon Network, which is a Layer 2 scaling solution for Ethereum. This is its core differentiating factor.

They share many similarities in their AMM model (including the evolution to concentrated liquidity with V3).

However, their primary differences stem from the blockchain networks they operate on and some ecosystem specifics:

Blockchain Network (The BIGGEST Difference):

- Uniswap: Originally and primarily operates on the Ethereum mainnet (Layer 1). While Uniswap has expanded to other chains (including Polygon, Arbitrum, Optimism), its roots and largest liquidity pools are historically on Ethereum.

- QuickSwap: Built natively on the Polygon Network (Layer 2). This is its raison d’être.

Transaction Fees (Gas Fees):

- Uniswap (on Ethereum): Transactions can incur high gas fees, especially during periods of high network congestion on Ethereum. This can make smaller trades or frequent interactions expensive.

- QuickSwap (on Polygon): Benefits from Polygon’s design, offering significantly lower gas fees (often fractions of a cent) and faster transaction times. This makes it much more accessible for users with smaller capital and for frequent trading or LP management.

Transaction Speed:

- Uniswap (on Ethereum): Transaction confirmation times can vary, sometimes taking minutes depending on network congestion.

- QuickSwap (on Polygon): Offers much faster transaction finality, often within a few seconds, enhancing the user experience.

Native Tokens:

- Uniswap: Uses UNI as its governance token.

- QuickSwap: Uses QUICK as its governance token.

Ecosystem and Interoperability:

- Uniswap: Part of the vast and mature Ethereum DeFi ecosystem. To use it on Polygon, you typically need to bridge assets from Ethereum to Polygon.

- QuickSwap: Integrally part of the Polygon ecosystem. It’s often the go-to DEX for swapping tokens directly on Polygon, avoiding the need to bridge to Ethereum for trades. It also facilitates bridging ERC-20 tokens from Ethereum to Polygon.

Capital Efficiency (V3):

- Both QuickSwap V3 and Uniswap V3 utilize concentrated liquidity. This means liquidity providers can specify a price range for their liquidity, leading to higher capital efficiency and potentially higher fee earnings within that range. The core mechanism for this is the same because QuickSwap V3 is a fork of Uniswap V3.

User Base and Liquidity:

- Uniswap: Generally has a larger overall user base and deeper liquidity across a wider range of tokens, particularly on Ethereum.

- QuickSwap: Has a significant user base and liquidity on Polygon, serving as a vital part of Polygon’s DeFi landscape.

In essence, QuickSwap can be thought of as Uniswap for Polygon.

It brings the familiar and successful AMM model of Uniswap to a Layer 2 network, addressing the scalability and high gas fee issues that can plague Ethereum mainnet DEXs, making decentralized trading more accessible and affordable for a broader range of users.

Quickswap-core repository contains the core smart contracts, and interface-v2 houses the code for their web interface.

There is a key distinction in how you earn as a liquidity provider in many DeFi protocols, especially with the introduction of V3 concentrated liquidity:

Pool APR (e.g., 39%):

- Source: This comes from the trading fees generated by swaps that happen within the USDC/USDT liquidity pool.

- Reward Token: Since these are trading fees from the USDC/USDT pair, your “reward” comes in the form of an increase in the value of your underlying USDC and USDT tokens within your liquidity position. If you deposit $1000 USDC and $1000 USDT, and you earn fees, your share of the pool effectively grows, meaning when you eventually withdraw, you’ll get back more than $1000 USDC and $1000 USDT (assuming the price stays within your range and no impermanent loss).

- How to access: These fees accrue directly to your LP position and might need to be “claimed” or simply increase the value of your LP tokens/NFT. To compound them, you’d typically withdraw them and then re-deposit them back into your LP position.

Rewards API (e.g., 4%):

- Source: This comes from liquidity mining or farm programs set up by QuickSwap or partner projects to incentivize liquidity to certain pools.

- Reward Token: These are usually paid out in the native token of the platform (QUICK), or sometimes in tokens of the project that is incentivizing the pool. In QuickSwap’s case, it’s typically QUICK.

- How to access: To earn these, you usually have to take an extra step: stake your LP position (which is an NFT in V3) into a designated “farm” on QuickSwap. The reward tokens (e.g., QUICK) will then accumulate in that farm, and you’ll need to manually “harvest” or “claim” them.

So, in your scenario:

- 39% Pool APR means you are earning more USDC and USDT proportional to your liquidity’s contribution to trades.

- 4% Rewards API means you are earning QUICK tokens (or another specific reward token, but most commonly QUICK for QuickSwap farms) for staking your USDC/USDT LP position.

This dual-earning structure is common in DeFi and is designed to provide both a share of the protocol’s revenue (fees) and additional incentives (farm rewards) to attract and retain liquidity.

Some dApps

Open Source, Permissionless & privacy conscious DeFi portfolio tracker

Start visualising and tracking 434 protocols across 17 blockchains.

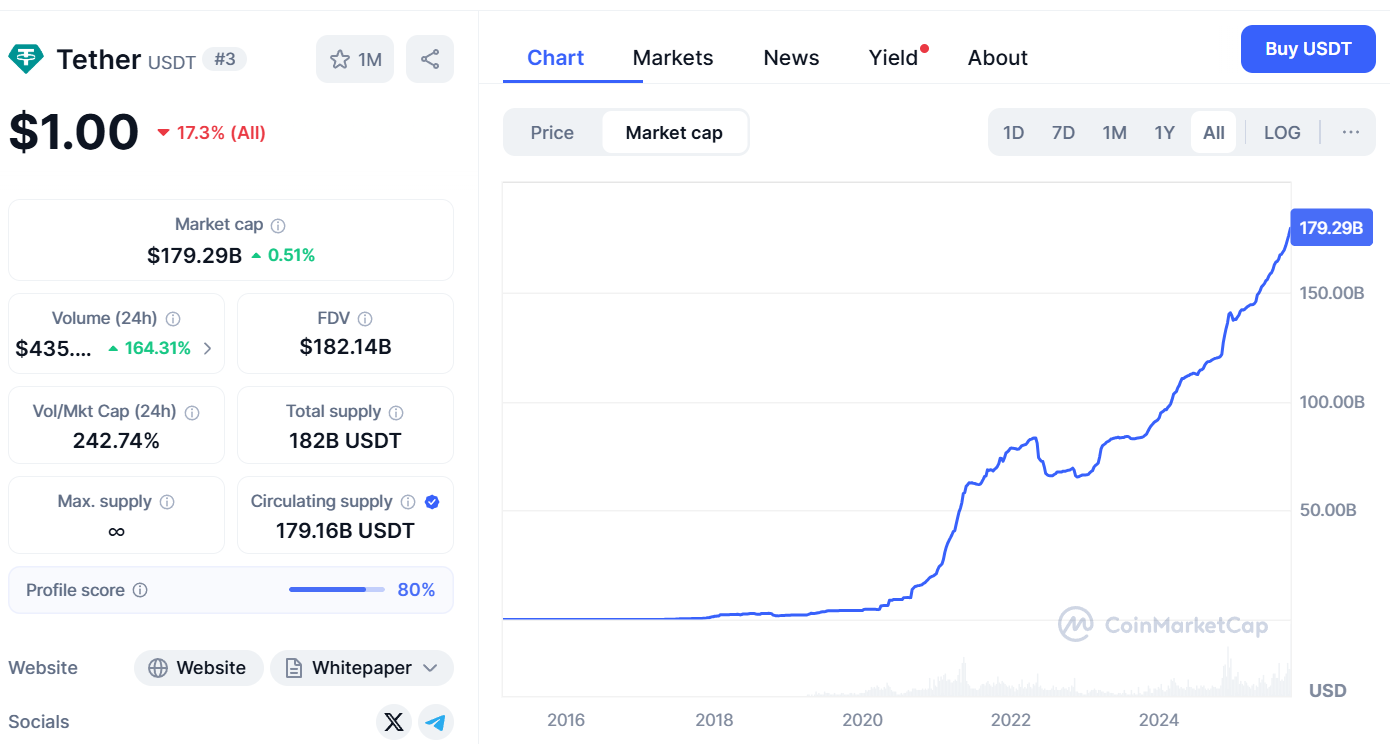

Stable Coins

Example stable coins are: USDT, USDC, DAI, USDS…

- https://defillama.com/stablecoins

- https://defillama.com/stablecoin/dai

- https://defillama.com/stablecoins/Polygon

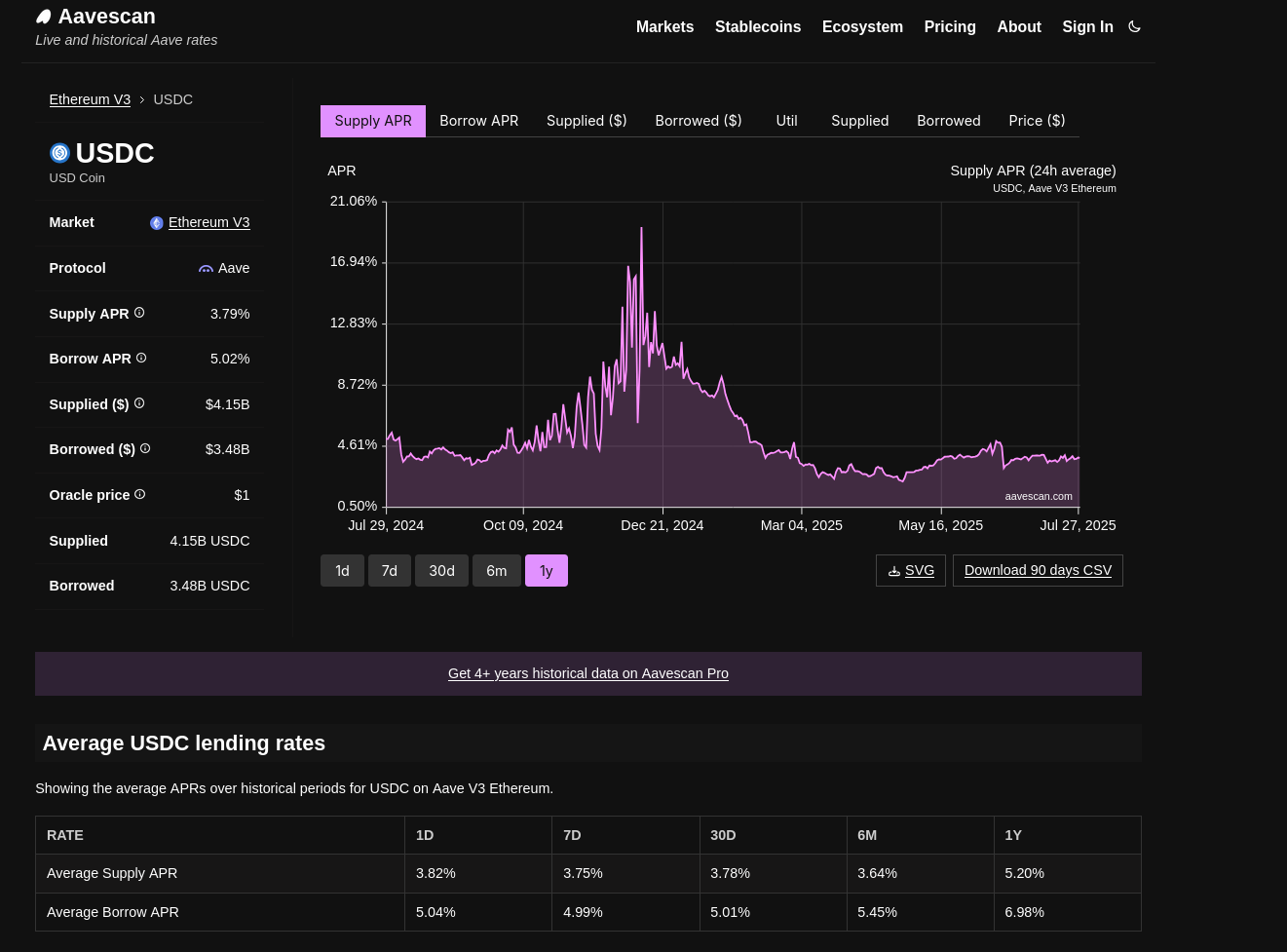

- https://aavescan.com/ethereum-v3/usdc

ERC20

You might have read about ERC20 compatible Tokens…well:

What cool things can be done with ERC20? USDC USDT DAI Transfers

It is possible to receive USDT, USDC, and DAI into an ERC-20 (Ethereum) wallet:

- DAI Contract Address: https://eth.blockscout.com/token/0x6B175474E89094C44Da98b954EedeAC495271d0F

- Tether (USDT): https://eth.blockscout.com/token/0xdAC17F958D2ee523a2206206994597C13D831ec7

- USDC: https://eth.blockscout.com/token/0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48

All three of these are commonly issued as ERC-20 tokens, meaning they operate on the Ethereum blockchain and are compatible with Ethereum addresses.

ERC-20 Compatibility:

- USDT, USDC, and DAI are designed to adhere to the ERC-20 token standard. This standard defines a set of rules and functions that allow these tokens to interact with the Ethereum blockchain and other ERC-20-compatible wallets.

- Therefore, any Ethereum wallet that supports ERC-20 tokens can receive and hold these cryptocurrencies.

Wallet Addresses:

- Your Ethereum wallet address is the same address you’ll use to receive all three tokens. You don’t need separate addresses for each.

Important Considerations:

- Network Fees (Gas): When sending or receiving ERC-20 tokens, you’ll need to pay Ethereum network fees (gas). These fees fluctuate depending on network congestion.

- Wallet Support: Ensure your wallet fully supports ERC-20 tokens. Most modern Ethereum wallets do, but it’s always good to double-check.

- Correct Network: It is vital that the sender of the tokens, sends them on the Ethereum network. If they send them on another network, such as the Tron network, the funds will most likely be lost.

- Contract Addresses: While you use your regular Ethereum address to receive these tokens, each token has its own unique contract address on the Ethereum blockchain. This contract address is used by the blockchain to identify the token. You do not need to use the contract address to receive the tokens.

You can confidently use your Ethereum (ERC-20) wallet address to receive USDT, USDC, and DAI.

For example, the aave token is ERC20:

Conclusions

After researching this, I got more questions than answers.

There is much more after the classical:

Not your keys

— @levelsio (@levelsio) November 27, 2024

Not your coins pic.twitter.com/GbVFVrvTKj

Specially after https://exponential.fi/ to Discover the best DeFi opportunities with expert research and risk insights.

To avoid smaller and frequent scams and non sense projects, have we got into a bigger and mandatory scam?

I got to know this defi app called MetaLend that consolidates what you have in a wallet: https://app.metalend.tech/#earn

Its a Defi Aggregator, as seen in Reddit.

They can tell you some ideas on where to lend (sorted by %).

Similarly, to what you can learn at DefiLLama: https://defillama.com/protocols/lending

Which is where I got to know about Fluid: https://defillama.com/protocol/fluid

Within fluid UI, you can see your total assets and how their value changed overtime

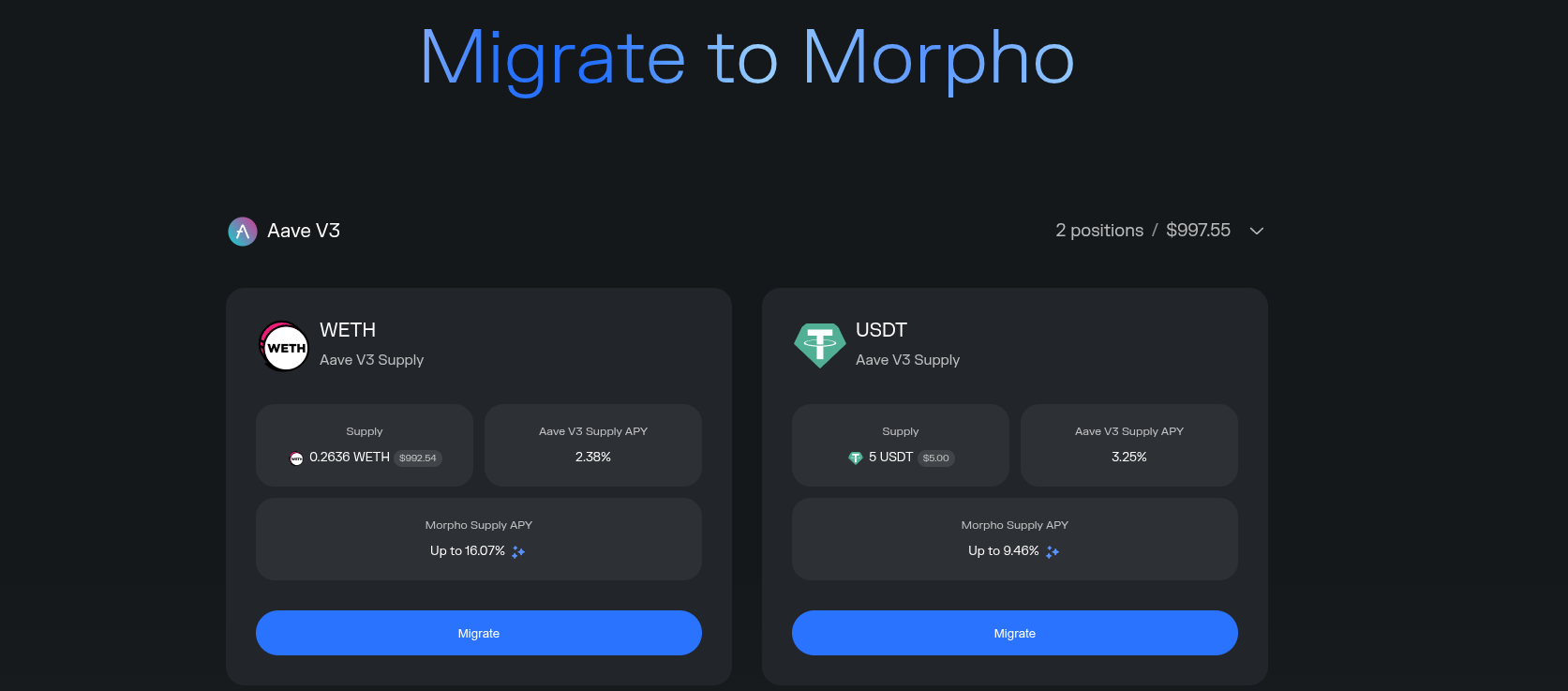

I also got to learn about another lending protocol called Morpho and Lulo:

From where it can detect what I have lended via Aave, my open positions.

ChainList is a list of EVM networks. Users can use the information to connect their wallets and Web3 middleware providers to the appropriate Chain ID and Network ID to connect to the correct chain.

I could not resist to try few protocols (under my own risk).

So…does the code explanations match what happened in reality?

Ive tried under my own risk of loosing it all with few Defi Protocols as per examples below.

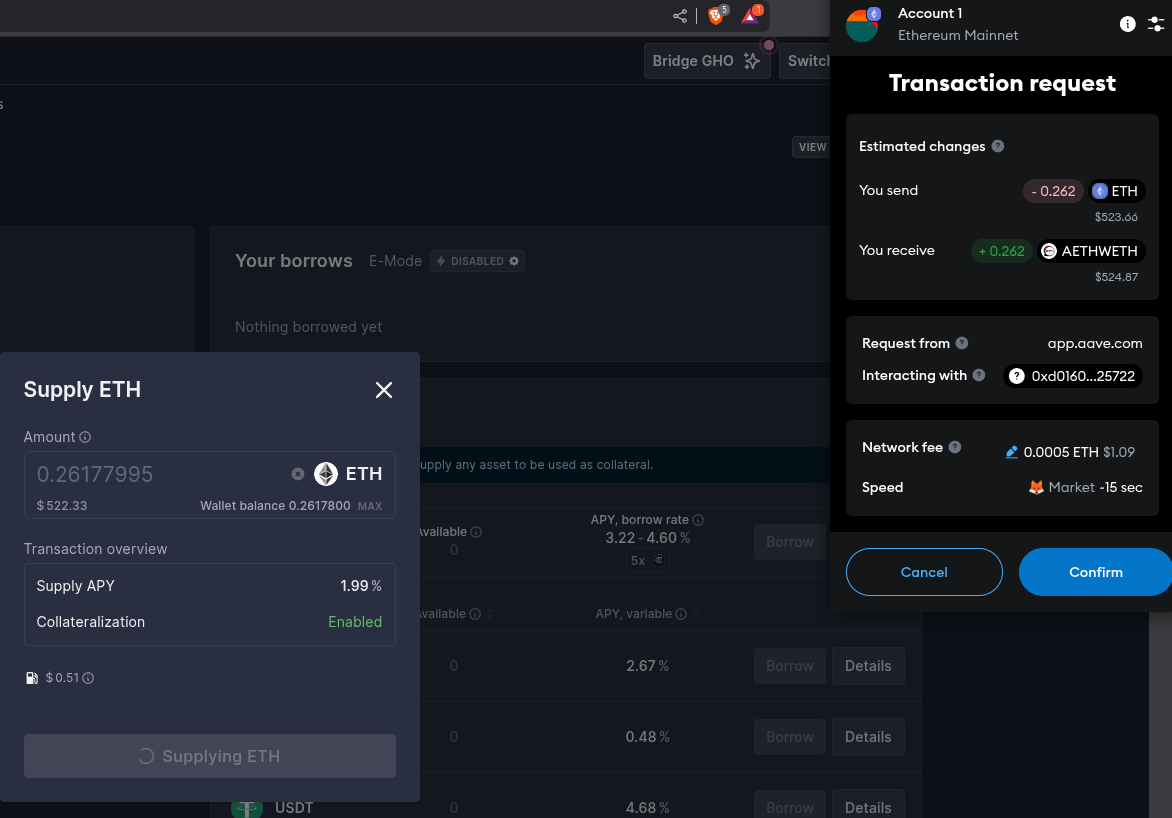

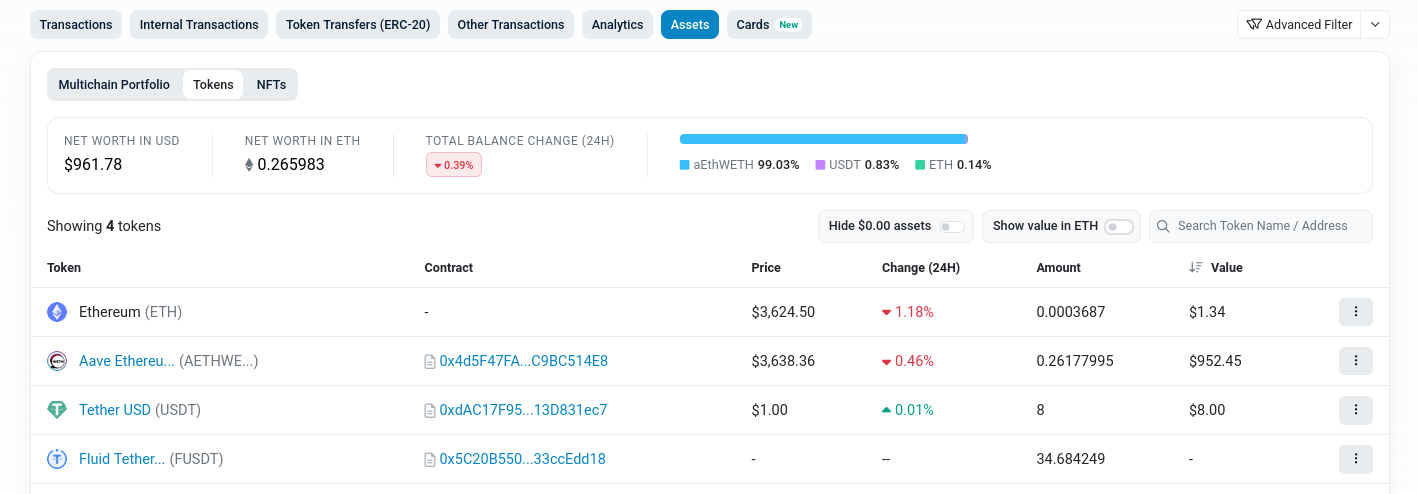

Crypto Example 1

Lending with Aave: https://aavescan.com/ethereum-v3/usdc

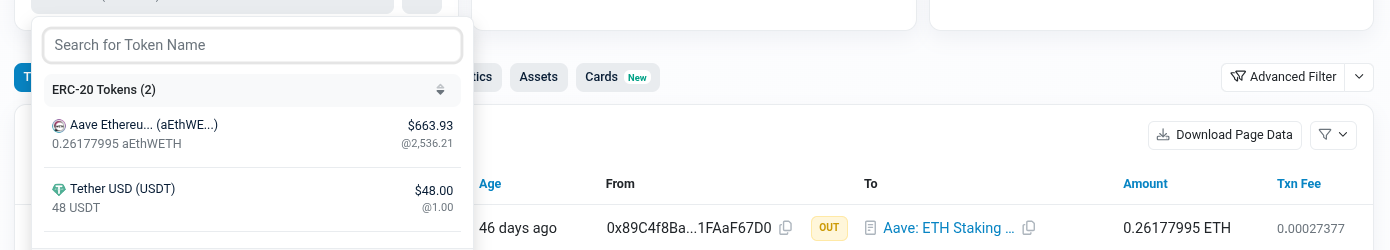

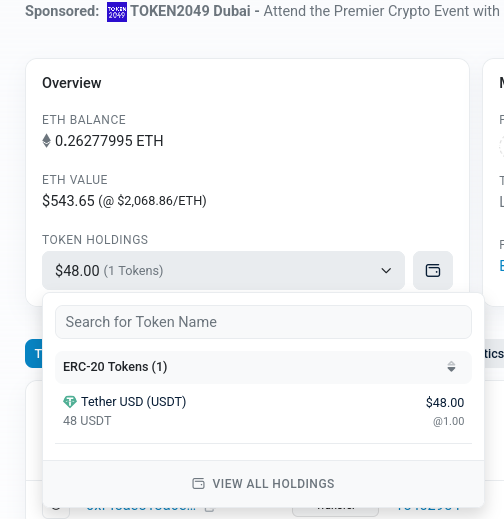

I lended ETH, which gave me aEthWETH mapped 1:1 with the amount deposited.

After some time, i started getting new ETH (TBC?)

The AAve ETH Staking smart contract: https://etherscan.io/address/0xd01607c3c5ecaba394d8be377a08590149325722#code

See how the interest floats freely between supply and demand:

Crypto Example 2

This relates with: https://instadapp.io/

The Unified Platform for Everything DeFi

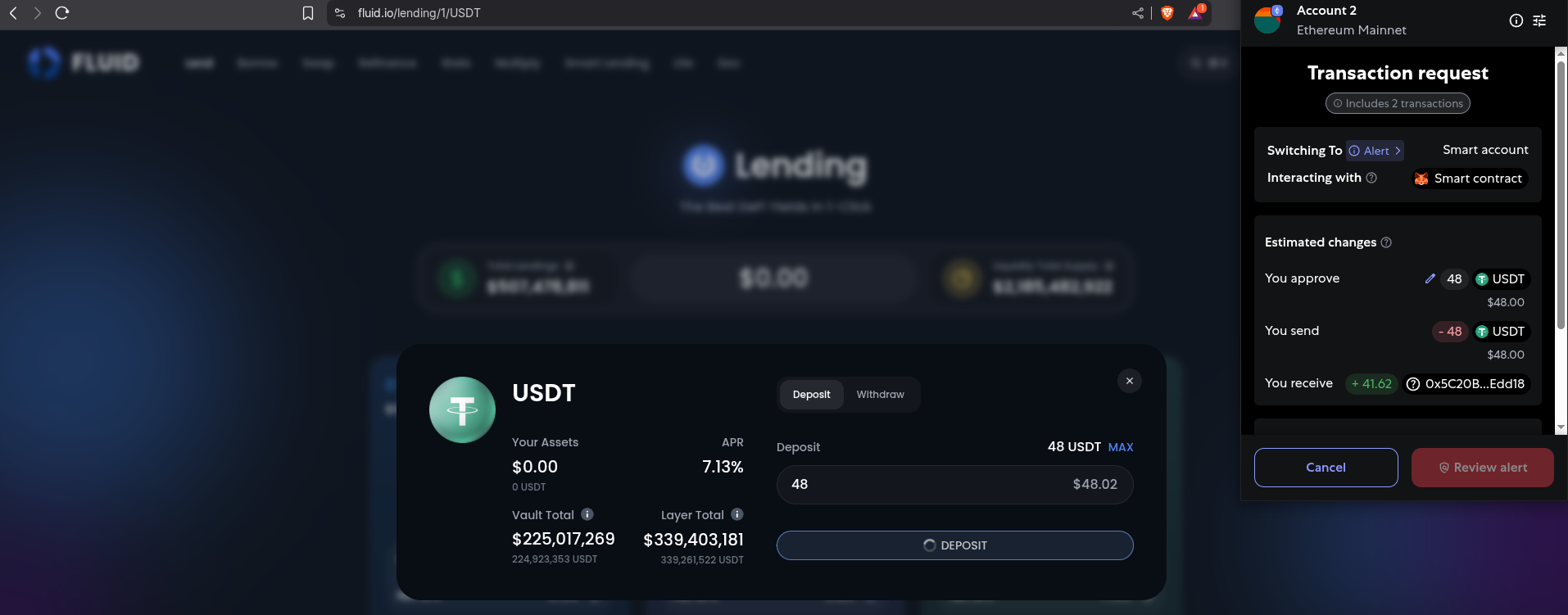

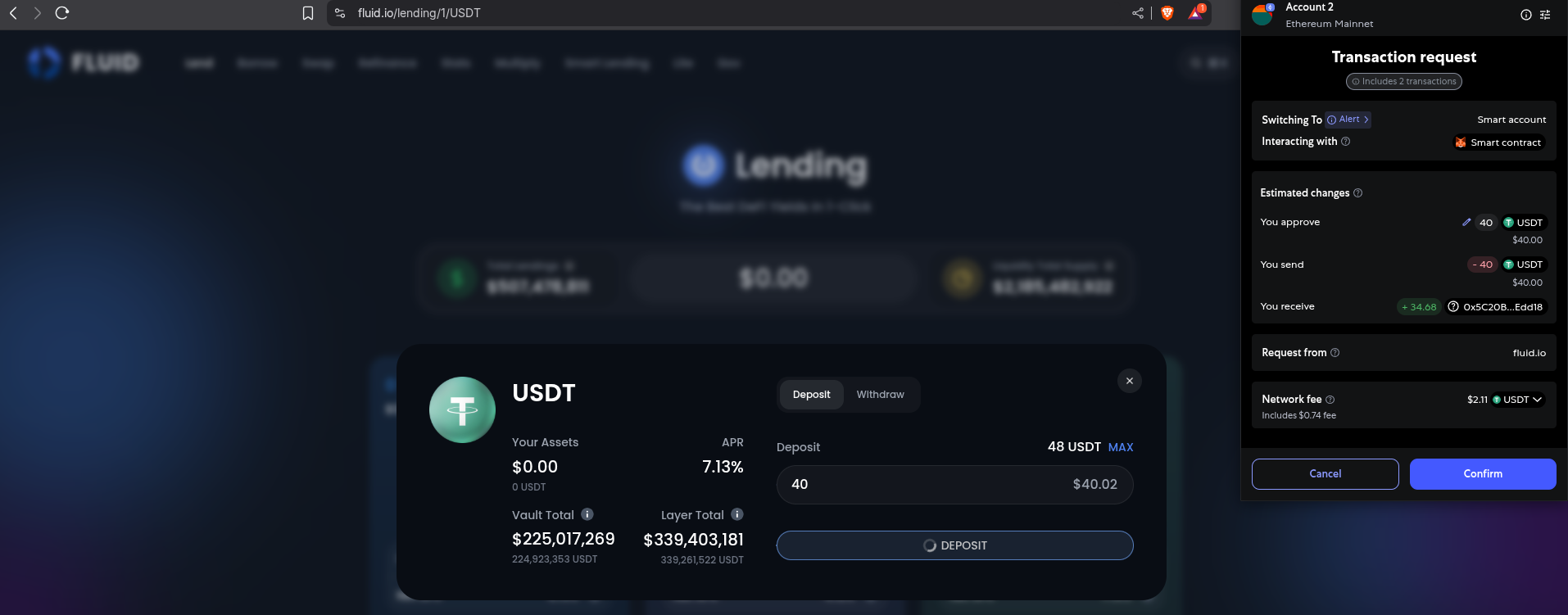

Lending with FLuid: https://fluid.io/lending/1

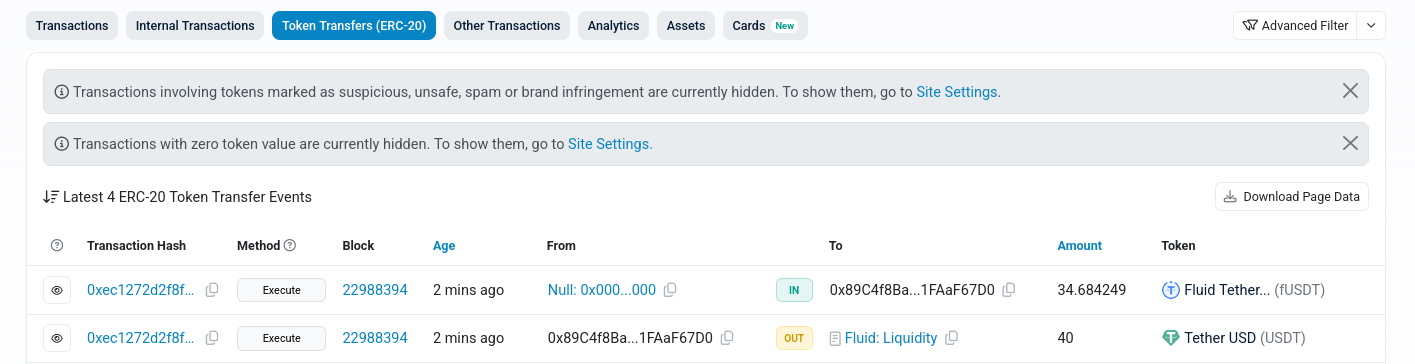

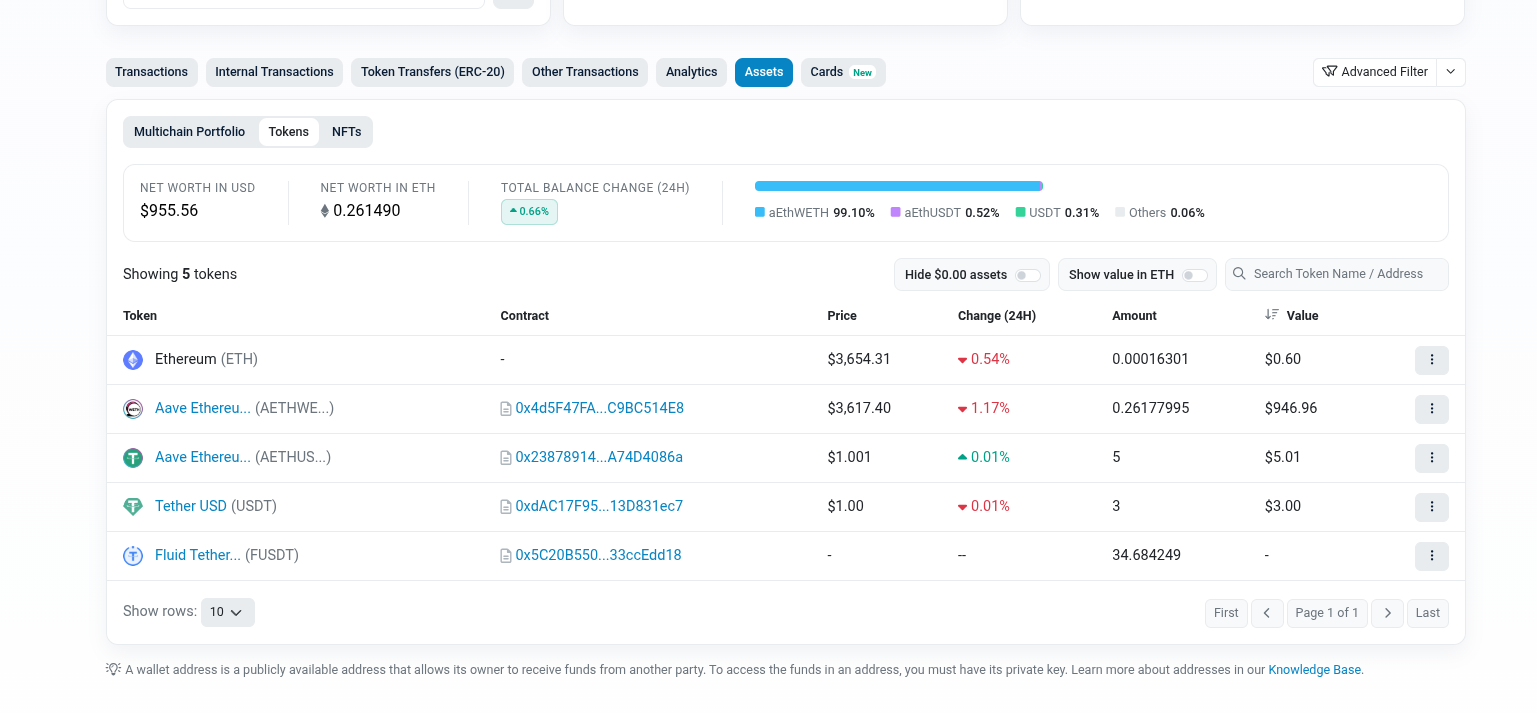

I tested it with lending USDT.

See USDT https://etherscan.io/token/0xdac17f958d2ee523a2206206994597c13d831ec7?a=0x52aa899454998be5b000ad077a46bbe360f4e497 with ~8M holders

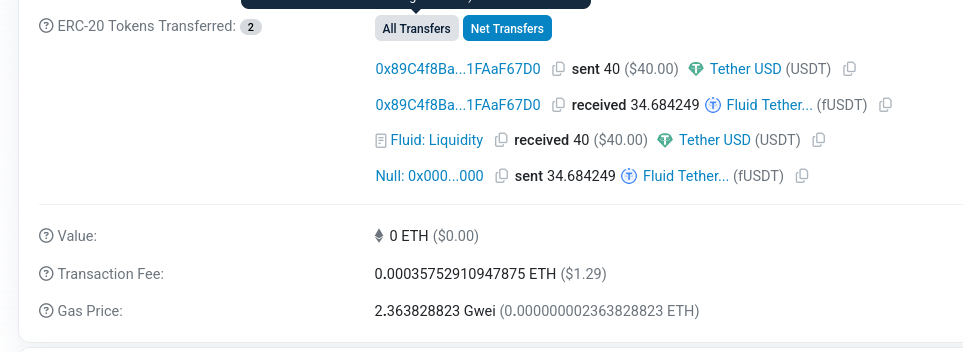

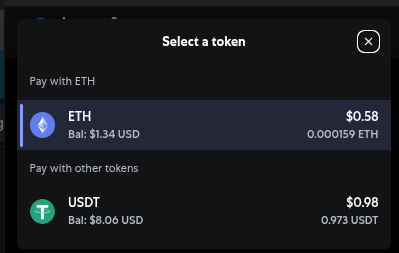

Placed 40$ in, and the transaction cost me some gas (2.11$ in USDT or 1.29$ in ETH == 2.363828823 Gwei)

You can pay in different tokens: because the transactions has some expenses, ofc!

I got 34.684249 fUSDT mapped to it, in theory to a ~7% interest: compared with the 2% you get on USD on xtb and the ~4% the FED stablishes

And now it appears:

NetAPR examples with Fluid and USDT:

To recover your initial investment of $40 after it dropped by 13% and then grew at an annual rate of 7%:

Value after the drop: Your investment of $40 dropped by 13%, meaning it became $40 \times (1 - 0.13) = 34.80.

Required growth to recover: To get back to $40 from $34.80, your investment needs to grow by a factor of 40/34.80 approx1.1494.

Time to recover: With an annual growth rate of 7% (0.07), it would take approximately 2.06 years to recover your initial investment.

See fUSDT: https://etherscan.io/token/0x5c20b550819128074fd538edf79791733ccedd18 with ~1k holders

See in your wallet transaction details

But I really didnt get the drop to 34 (-13,3%), despite showing 40$ value on the UI…

As we are here for the code and how AI can interprete it, this is the fluid Smart Contract: https://etherscan.io/address/0x5C20B550819128074FD538Edf79791733ccEdd18#code

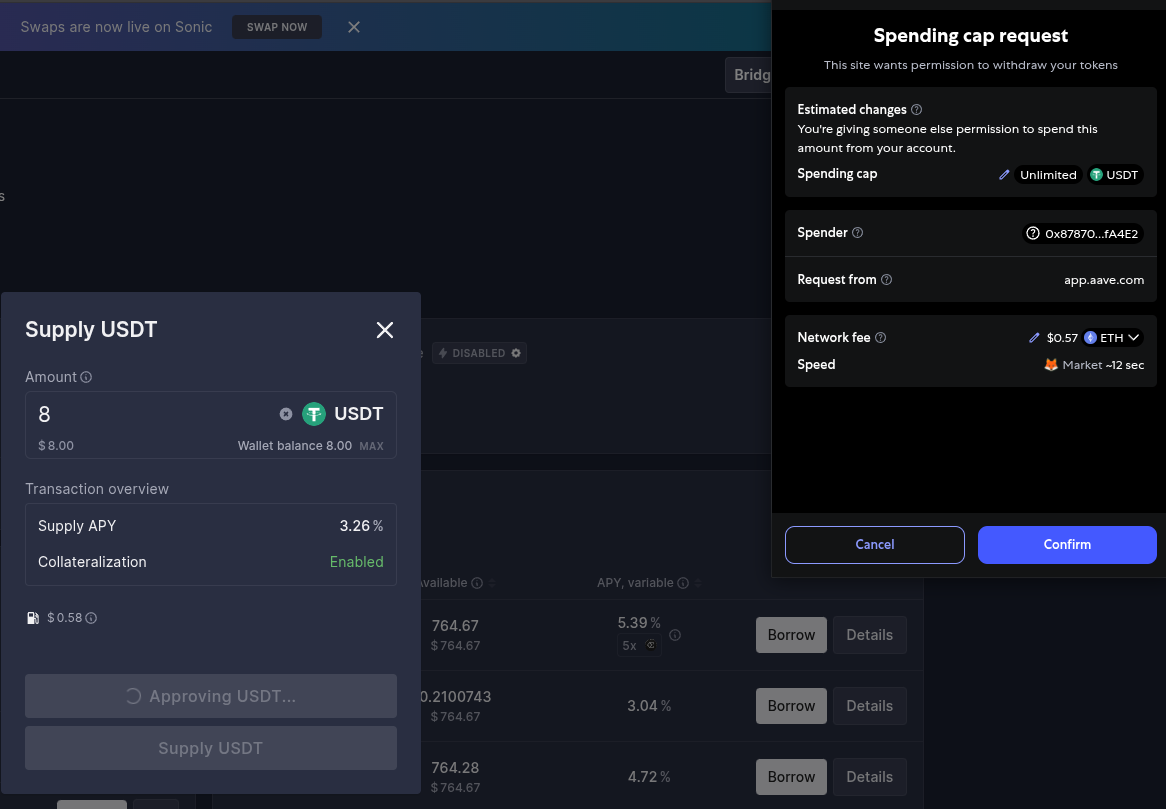

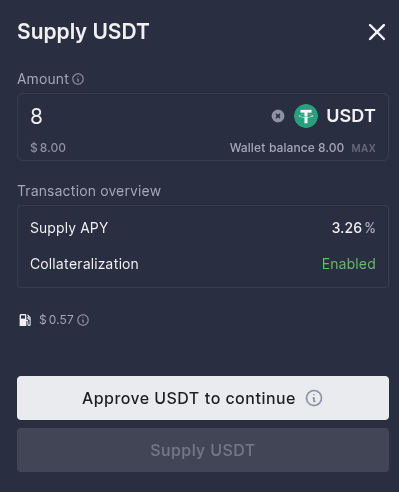

Crypto Example 3

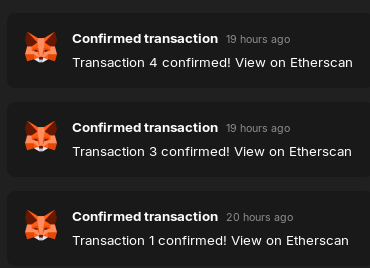

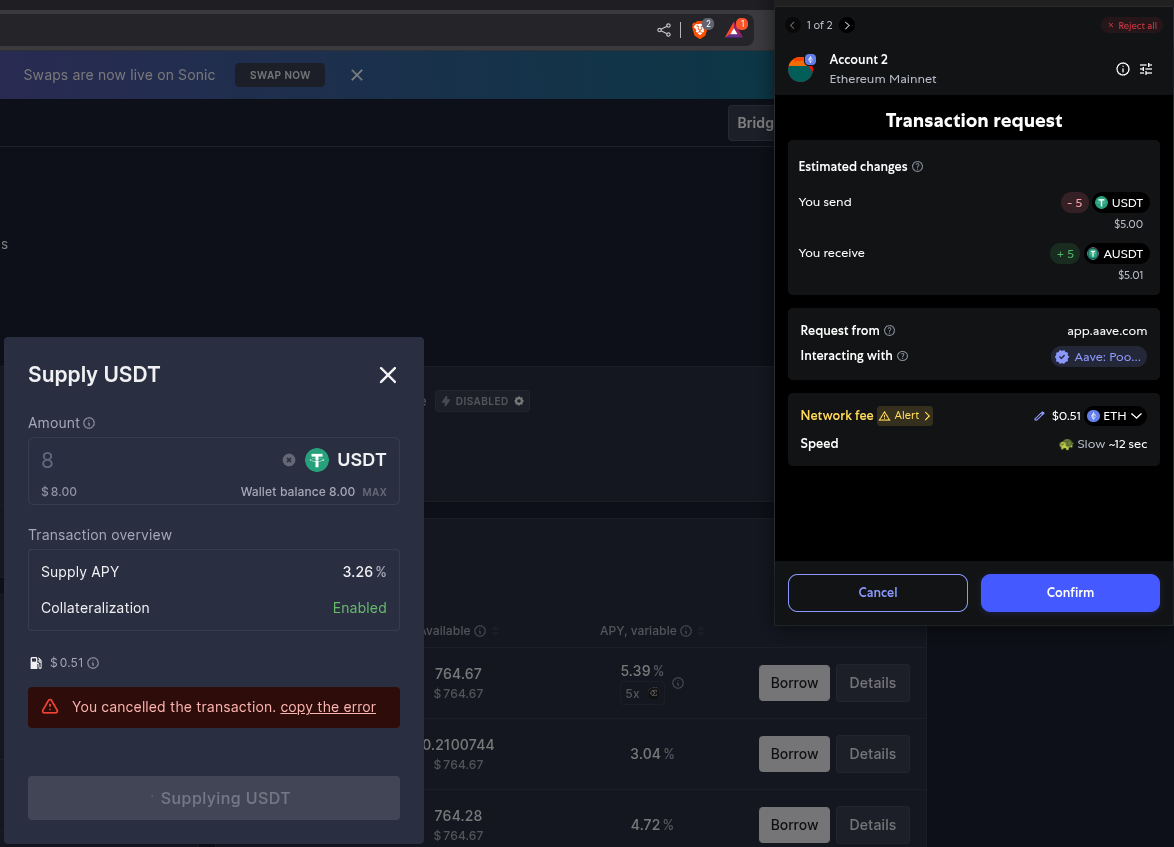

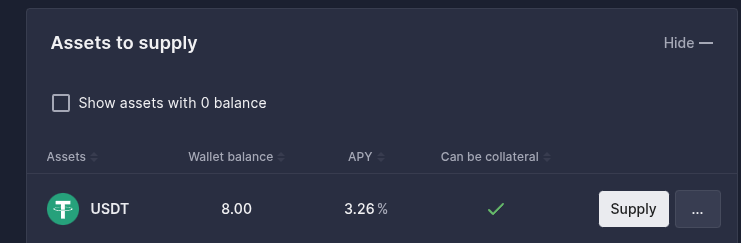

I could not resist to go back to aave v3 and lend the rest of USDT for comparison: Here with a ~3.26% interest.

8 USDT supplied, ~0.44$ usd paid in gas fees via eth (2461719711 wei)

But something went wrong, and the gas was spent, yet the 8 USDT werte still at my wallet.

So i tried again with 5USDT (and slow speed to safe some gas, as i have to pay again 0.456722383 Gwei)

Then, I got aEthUSDT https://etherscan.io/token/0x23878914efe38d27c4d67ab83ed1b93a74d4086a with a ~3,26% interest

If someone borrow, it will do 4,72%

After spending some eth in these transactions, this is how the asset looks like:

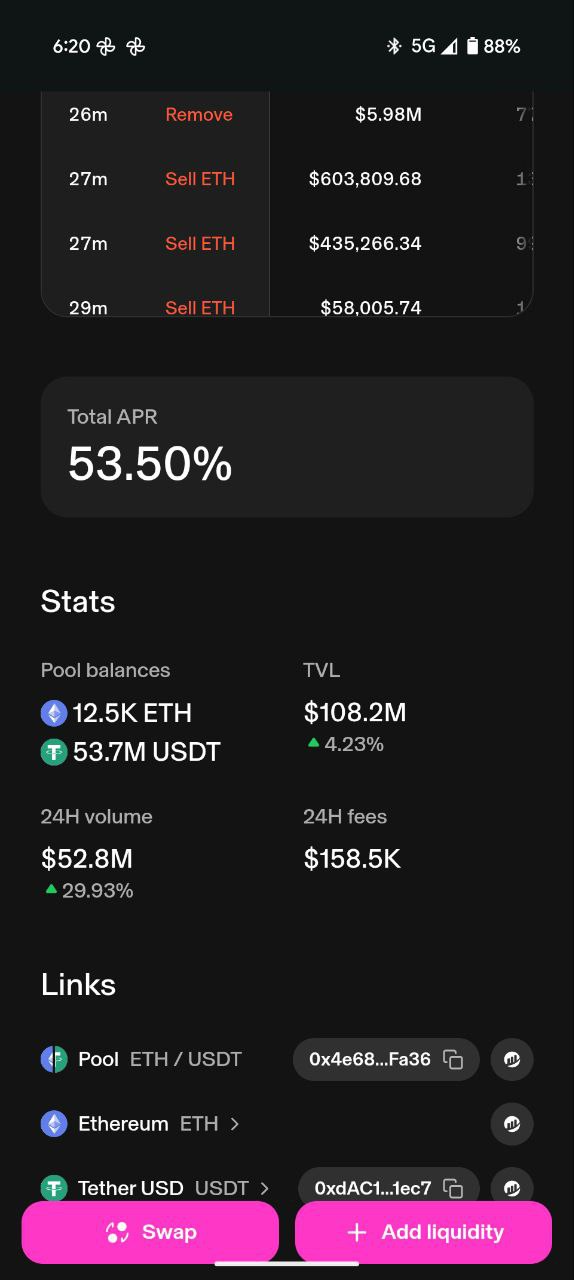

Crypto Example 4

Testing the Liquidity providing into a Dex.

Because people like to change token pairs and you can provide such tokens.

Basically, just be in between people exchanging the pairs, for example this one.

This has some risks, like IP!

So again, be mindful about all the things that can go very wrong with these operations.

- https://dapp.quickswap.exchange/farm

- https://app.uniswap.org/explore/pools

- Example of how to create a position

What if I LP ETH and USDT into Uniswap… 🚀?

If you put ETH and USDT into a Uniswap pool, you would be acting as a Liquidity Provider (LP) on a Decentralized Exchange (DEX) using the Automated Market Maker (AMM) model.

Here’s a breakdown of what you would get and the considerations, especially since you’d likely be using Uniswap V3:

What You’ll Get (The Rewards)

Trading Fees (The Primary Incentive):

- You will earn a percentage of the trading fees generated by every swap between ETH and USDT that occurs in the pool.

- Uniswap V3 offers multiple fee tiers (e.0.01%, 0.05%, 0.3%, 1%). The ETH/USDT pool is typically in a higher fee tier (often 0.3% or 0.05%) because ETH is volatile relative to USDT.

- These fees accrue to your liquidity position, meaning the value of your ETH and USDT in the pool will gradually increase.

- You receive a pro-rata share of these fees based on how much liquidity you’ve provided and whether your liquidity is within the active price range.

LP NFT (Your Proof of Ownership):

- Unlike Uniswap V2 which gave you fungible ERC-20 LP tokens, Uniswap V3 issues you a unique ERC-721 NFT (Non-Fungible Token).

- This NFT represents your specific liquidity position, including the exact price range you set and the amount of liquidity you provided within that range. It’s your “receipt” and proof of ownership. You need this NFT to manage or withdraw your liquidity and accrued fees.

Potential Farm Rewards (if applicable):

- Sometimes, projects (including Uniswap in the past through governance votes) will offer additional liquidity mining incentives (farm rewards) on top of the trading fees. These would typically be paid out in the project’s native token (like UNI for Uniswap, or another token from a partnering project).

- To earn these, you usually need to take an extra step: stake your Uniswap V3 LP NFT into a designated farm contract. Not all pools have active farm rewards, so you’d need to check the Uniswap interface or third-party analytics sites.

What You Need to Consider (The Risks & Mechanics)

Impermanent Loss (IL):

- This is the most significant risk when providing liquidity for volatile pairs like ETH/USDT.

- How it works: If the price ratio between ETH and USDT changes significantly from when you deposited them (e.g., ETH’s price goes up or down relative to USDT), you will experience impermanent loss. The AMM constantly rebalances the pool, so if ETH increases, you’ll end up with less ETH and more USDT than if you had just held (HODLed) both assets outside the pool. Conversely, if ETH drops, you’ll end up with less USDT and more ETH.

- Impact: For highly volatile pairs like ETH/USDT, impermanent loss can often outweigh the earned trading fees, leading to a net loss compared to simply holding your assets. Research has shown that a significant portion of Uniswap V3 LPs are unprofitable after accounting for IL.

Concentrated Liquidity (V3 Specific):

- Uniswap V3 introduced “concentrated liquidity,” meaning you must define a price range within which you want to provide liquidity (e.g., ETH price between $3,000 and $4,000 against USDT).

- Capital Efficiency: This allows for much higher capital efficiency, as your capital is concentrated where most trading occurs, potentially earning more fees for a given amount of capital.

- Active Management: If the price of ETH moves outside your chosen range, your liquidity becomes inactive and stops earning fees. To continue earning, you would need to either wait for the price to return to your range or manually adjust your range (which incurs gas fees). This often requires a more active, market-making approach, or the use of automated liquidity management services.

- Increased Impermanent Loss Risk (if not managed): While concentrated liquidity offers higher fee potential, it can also amplify impermanent loss if not managed well, as your position can quickly go out of range in volatile markets.

Example: https://app.uniswap.org/explore/pools/ethereum/0x4e68Ccd3E89f51C3074ca5072bbAC773960dFa36

Gas Fees:

- Since Uniswap’s largest pools are on the Ethereum mainnet, providing liquidity, adjusting ranges, claiming fees, and withdrawing liquidity will incur significant Ethereum gas fees. This can eat into your profits, especially for smaller positions or frequent management.

- (Remember, if you used Uniswap on a Layer 2 like Polygon or Arbitrum, gas fees would be much lower, making LPing more accessible).

Smart Contract Risk:

- As with any DeFi protocol, there’s a risk of bugs, vulnerabilities, or exploits in Uniswap’s smart contracts that could lead to loss of funds.

In summary:

When you put ETH and USDT into a Uniswap V3 pool, you are attempting to earn trading fees and potentially farm rewards by facilitating swaps.

However, you are taking on significant impermanent loss risk due to the volatility of ETH, and you’ll need to actively manage your concentrated liquidity position (or pay a service to do so) to ensure your capital remains active and earns fees, all while navigating Ethereum’s potentially high gas fees.

You’re asking about the different types of earnings you get when providing liquidity on a DEX like Uniswap, specifically for an ETH/USDT pair. And yes, you’ve pretty much nailed the distinction!

When you LP ETH and USDT into a Uniswap V3 pool, your earnings will typically come from two main components:

Pool APR (from Trading Fees):

- This is the primary and most consistent source of revenue for LPs on an AMM like Uniswap.

- How it works: Every time a user swaps ETH for USDT, or USDT for ETH, they pay a small trading fee (e.g., 0.05%, 0.3%, or 1% depending on the pool’s fee tier). This fee is added back into the liquidity pool.

- What you get: You, as an LP, earn a pro-rata share of these accumulated fees based on how much liquidity you provided and whether your liquidity is within the active price range. These fees effectively increase the amount of ETH and USDT you hold within your LP position. When you eventually withdraw your liquidity, you’ll get back more of the tokens than you initially put in (assuming enough fees were earned to offset any impermanent loss).

- Displayed as: Often shown as “Pool APR” or “LP Fees APR” on the DEX interface.

Rewards API (from Liquidity Mining / Farm Rewards):

- This is an additional incentive layer that may or may not be active for a particular pool.

- How it works: Projects (including Uniswap itself, through governance, or other protocols building on Uniswap’s liquidity) might offer extra tokens to LPs in specific pools to encourage deeper liquidity. For Uniswap, this would typically be UNI tokens, or tokens from a partner project (e.g., if a new project wanted to attract liquidity for its token paired with ETH, it might offer its own tokens as rewards).

- What you get: You receive these additional tokens (e.g., UNI, or the partner project’s token) on top of the trading fees. To earn these, you usually have to take an extra step: stake your Uniswap V3 LP NFT (which represents your liquidity position) into a designated “farm” or “rewards contract.”

- Displayed as: Often shown as “Farm APR,” “Rewards APR,” or indicated through an “API” (Application Programming Interface) that displays these additional earnings.

So, yes:

- One part of your earnings (the Pool APR) will be in the form of more of the paired assets (ETH and USDT). These are your share of the trading fees.

- The other part (the Rewards API) will be in the form of a separate, specified reward token (e.g., UNI), which you get for participating in a liquidity mining program for that pool.

It’s crucial to distinguish between these two sources, as their value and consistency can differ. The Pool APR from trading fees is directly tied to trading volume and fee tier. The Rewards API is dependent on the duration and emission schedule of the incentive program.

FAQ

Chain Comparison

Bitcoin, Ethereum, Solana, and Polkadot: A Comparative Overview

| Feature | Bitcoin | Ethereum | Solana | Polkadot |

|---|---|---|---|---|

| Primary Function | Digital currency | Smart contract platform | High-throughput blockchain | Interoperable blockchain network |

| Consensus Mechanism | Proof-of-Work (PoW) | Proof-of-Stake (PoS) | Proof-of-History (PoH) + Proof-of-Stake (PoS) | Nominated Proof-of-Stake (NPoS) |

| Transaction Speed | ~7 transactions per second (TPS) | ~30 TPS (pre-Merge) | Up to 65,000 TPS | Up to 1,000 TPS |

| Transaction Fees | Relatively high | Can vary significantly | Low | Low |

| Smart Contracts | Limited | Supports complex smart contracts | Supports smart contracts | Supports parachains for custom blockchains |

| Scalability | Limited | Improving with layer-2 solutions | High | High |

| Interoperability | Limited | Improving with bridges | Limited | High |

Programming

- Solidity is primarily used for developing smart contracts on the Ethereum blockchain.

- Other blockchains, like Solana, have their own programming languages (e.g., Rust for Solana).

- Polkadot, being a network of interconnected blockchains (parachains), allows for diverse programming languages depending on the specific parachain.

Open-Source Wallets

- Bitcoin: Electrum, Bitcoin Core, Mycelium. You also have Proton Wallet

#flatpak install flathub org.electrum.electrum- Ethereum: MetaMask, MyEtherWallet, Trust Wallet

- Solana: Phantom, Sollet, Solflare

- Polkadot: Polkadot.js, Talisman

Crypto Concepts

- Impermanent Loss (IL)

This can happen when the value of 2 assets deposited in a pool diverse: https://app.beefy.com/vault/nuri-cow-scroll-wbtc-weth-vault

beefy is a Multichain Yield Optimizer

- You can Stake using Smart Contract Protocols like Aave: https://app.aave.com/

And you receive some tokens while your assets are staked: https://etherscan.io/token/0x4d5f47fa6a74757f35c14fd3a6ef8e3c9bc514e8

- Sample wallet: metamask is quite popular, but there are many OSS wallets

- https://portfolio.metamask.io/stake?tab=pooled

- For other currencies you can have a look to feather wallet or electrum.

You can find your wallet address / transactions and so on at https://etherscan.io/address/

- DeFi space is huge and full of information

Lending vs Dex

- When you lend one token only (e.g., just USDC) on Aave or Compound, you are NOT providing to a DEX’s liquidity pool in the same way you would on Uniswap or QuickSwap.

Let’s clarify the categories and their mechanisms:

Lending Protocols (Aave, Compound)

Category: Decentralized Lending and Borrowing Protocols.

Purpose: To enable users to lend out their crypto assets to earn interest, and to borrow crypto assets by providing collateral.

Mechanism:

- Lending Pools (Supply Side): Lenders deposit their single asset (e.g., USDC) into a lending pool (also known as a “money market” or “liquidity market”). These pools are managed by smart contracts. The funds in this pool are then available for borrowers to take out. Lenders earn interest, which is paid by the borrowers.

- Borrowing (Demand Side): Borrowers deposit collateral (often a different crypto asset, and usually more than the amount they want to borrow, i.e., “overcollateralized”) into a separate smart contract, and then they can borrow a single asset from the lending pool.

- Interest Rates: Interest rates for both lenders and borrowers are typically determined algorithmically based on the supply and demand within that specific lending pool (i.e., how much is being supplied vs. how much is being borrowed).

- Tokens Received: When you lend on Aave, you receive “aTokens” (e.g., aUSDC for USDC). On Compound, you receive “cTokens” (e.g., cUSDC for USDC). These tokens represent your deposit plus accrued interest and can often be used as collateral in other DeFi protocols.

Your Action: You provide a single asset (e.g., 1000 USDC) to earn interest on that specific asset. You are not pairing it with another asset to facilitate swaps.

DEXs (Decentralized Exchanges) with AMMs (Uniswap, QuickSwap)

Category: Decentralized Exchanges (DEXs), specifically using the Automated Market Maker (AMM) model.

Purpose: To facilitate permissionless and automated swaps/exchanges between different crypto assets.

Mechanism:

- Liquidity Pools: As discussed, these require LPs to deposit two (or sometimes more) different tokens in equivalent value into a pool (e.g., 1000 USDC and 1000 USDT). This pair forms the “market” for users to swap between those two assets.

- Trading Fees: LPs earn a portion of the trading fees generated when users swap against their provided liquidity.

- Impermanent Loss: A risk unique to AMM liquidity pools, where the price ratio of the paired assets changes, potentially leading to a loss compared to simply holding the assets.

- Tokens Received: When you provide liquidity, you receive LP tokens (or an LP NFT in V3), which represent your share of the pool and accrue the trading fees.

Your Action: You provide a pair of assets (e.g., USDC/USDT) to enable trading between them and earn trading fees.

Summary of the Difference:

| Feature | Lending Protocols (Aave, Compound) | DEXs with AMMs (Uniswap, QuickSwap) |

|---|---|---|

| Primary Function | Lending and Borrowing of assets | Facilitating Swaps/Exchanges between assets |

| LP Deposit | Single asset (e.g., USDC) | Pair of assets (e.g., USDC + USDT) in equivalent value |

| LP Earnings | Interest paid by borrowers on the lent asset | Trading fees from swaps; sometimes also farm rewards (in a separate step) |

| Main Risk | Liquidation risk for borrowers; smart contract risk for lenders. | Impermanent Loss for LPs; smart contract risk |

| Output Token | aTokens (Aave) or cTokens (Compound) representing your deposit + interest | LP tokens/NFT representing your share of the liquidity pool + fees |

What are Staking Protocols?

“Staking protocols” represent another distinct category within the blockchain and DeFi ecosystem, though there can be some overlap in terms of earning rewards.

Staking Protocols (e.g., Ethereum (PoS), Solana, Cardano, Polkadot)

Category: Primarily related to blockchain consensus mechanisms, specifically Proof-of-Stake (PoS).

Purpose: To secure a blockchain network, validate transactions, and create new blocks.

Mechanism:

- Locking Assets: In a Proof-of-Stake blockchain, instead of “mining” (like in Proof-of-Work Bitcoin), validators (or users who delegate to validators) “stake” (lock up) a certain amount of the blockchain’s native cryptocurrency as collateral. This stake acts as a financial incentive to behave honestly.

- Validation: These staked tokens give validators the right to participate in the network’s consensus process (e.g., proposing new blocks, verifying transactions).

- Rewards: In return for helping to secure the network and validate transactions, stakers earn newly minted tokens from the blockchain or a portion of transaction fees.

- Slashing: If a validator acts maliciously or goes offline, a portion of their staked tokens can be “slashed” (forfeited) as a penalty.

- No Pair Required: You typically stake a single asset (the native token of the blockchain, e.g., ETH, SOL, ADA, DOT).

- Lock-up Periods: Often, tokens staked directly on a blockchain are locked for a specific period (unbonding period) during which they cannot be traded or moved.

Famous Staking Protocols (Blockchains):

- Ethereum (since “The Merge”): You can stake ETH directly (requiring 32 ETH to run a full validator node) or through staking pools.

- Solana (SOL): Users can delegate their SOL to validators.

- Cardano (ADA): Users can delegate their ADA to stake pools.

- Polkadot (DOT): Uses a Nominated Proof-of-Stake (NPoS) model where DOT holders nominate validators.

- Cosmos (ATOM): Known for its “Internet of Blockchains” and allows staking ATOM.

- Avalanche (AVAX): Allows staking AVAX to secure its network.

Sub-categories of Staking:

- Direct Staking: Staking directly on the blockchain, either by running your own validator node or delegating to one.

- Pooled Staking: Multiple users contribute smaller amounts to reach the minimum required for a validator node, and rewards are shared proportionally.

- Liquid Staking: This is a newer innovation that solves the “lock-up” problem of traditional staking.

- When you stake ETH (or other assets) with a liquid staking protocol (like Lido Finance or Rocket Pool for Ethereum, Marinade Finance for Solana), you receive a liquid staking token (LST) in return (e.g., stETH for staked ETH).

- This LST is pegged 1:1 to the value of your staked asset and can be freely traded, used as collateral in lending protocols (like Aave!), or deployed in DEX liquidity pools.

- You continue to earn staking rewards on your original staked asset while having liquidity with the LST. This effectively “unlocks” the capital that would otherwise be locked.

- Restaking (Emerging Concept): This is even newer, championed by protocols like EigenLayer on Ethereum.

- Restaking allows users to re-purpose their already staked ETH (or liquid staked ETH like stETH) to simultaneously secure other decentralized applications or “actively validated services” (AVSs) in addition to the Ethereum blockchain itself.

- In return, restakers earn additional rewards from these AVSs, effectively “stacking” yield. It increases the economic security of the broader ecosystem but also introduces new layers of complexity and slashing risks.

Key Differences Summarized:

| Feature | Lending Protocols (Aave, Compound) | DEXs with AMMs (Uniswap, QuickSwap) | Staking Protocols (Ethereum PoS, Solana, Lido) |

|---|---|---|---|

| Core Purpose | Lending & Borrowing crypto assets | Facilitating token swaps (trading) | Securing a blockchain network (Proof-of-Stake consensus) |

| Your Action | Deposit single asset to earn interest. | Deposit pair of assets to facilitate trades. | Lock/delegate single asset to validate/secure the blockchain. |

| Main Earnings | Interest paid by borrowers. | Trading fees from swaps; optionally farm rewards. | Block rewards (newly minted tokens) & transaction fees from the blockchain. |

| Primary Risk | Liquidation risk (for borrowers); Smart contract risk. | Impermanent Loss; Smart contract risk. | Slashing risk (for validators); Smart contract risk; Price volatility of staked asset. |

| Output | aTokens / cTokens (receipt of deposit + interest) | LP tokens / LP NFT (share of pool + fees) | Staked tokens (locked); or Liquid Staking Tokens (LSTs like stETH). |

| Capital Lockup | Funds can usually be withdrawn on demand (subject to liquidity). | Funds locked in LP pool (subject to withdrawal). | Often involves lock-up/unbonding periods (traditional staking). LSTs solve this. |

While these categories are distinct, DeFi is all about composability (or “money Legos”).

This means these protocols can often be combined: for example, you might take your stETH (from a liquid staking protocol) and deposit it into an Aave lending pool to earn additional interest, or provide it to an stETH/ETH liquidity pool on Uniswap V3.

This layering of protocols is what makes DeFi so powerful and complex.

Comparing the Risks

When comparing the risk profiles of staking, lending, and providing liquidity (LPing) into a DEX with stablecoins, it’s essential to understand the unique risks associated with each.

According to Gemini This is a breakdown, generally from lowest to highest relative risk, along with the “why”:

- Lending Stablecoins (e.g., Aave, Compound with USDC/USDT)

- Risk Level: Generally considered the lowest risk among the three, especially when using well-established, fully-backed stablecoins like USDC and USDT.

- Why:

- No Impermanent Loss: This is the biggest advantage. Since you’re depositing a single asset, there’s no price divergence between two assets in a pair, thus no impermanent loss.

- Stablecoin Peg Risk is Minimized (for major ones): While not zero, the risk of major stablecoins like USDC or USDT permanently losing their peg to the USD is relatively low due to their backing and regulatory scrutiny (though temporary de-pegs can occur, as seen with SVB and USDC).

- Simple Mechanism: You’re simply providing liquidity to a borrowing pool. The smart contracts are typically simpler than those for AMMs or complex staking derivatives.

- Primary Risks:

- Smart Contract Risk: The most significant risk. Bugs, exploits, or hacks in the Aave or Compound smart contracts could lead to loss of funds. Protocols mitigate this with audits, bug bounties, and sometimes insurance.

- Liquidity Risk: In extreme market conditions, borrowers might not be able to repay, or there might be high demand for withdrawals, leading to periods where you cannot immediately withdraw your funds from the lending pool. While these protocols have mechanisms (like variable interest rates that increase to incentivize deposits) to balance this, it’s a possibility.

- Oracle Risk: Lending protocols rely on external price feeds (oracles) to determine collateral values and trigger liquidations. If an oracle is manipulated or provides incorrect data, it could lead to bad debt or unfair liquidations.

- Centralization Risk of Stablecoin: If the stablecoin itself (USDC or USDT) were to suffer a major, permanent de-peg due to issuer insolvency or regulatory action, the value of your lent assets would decline.

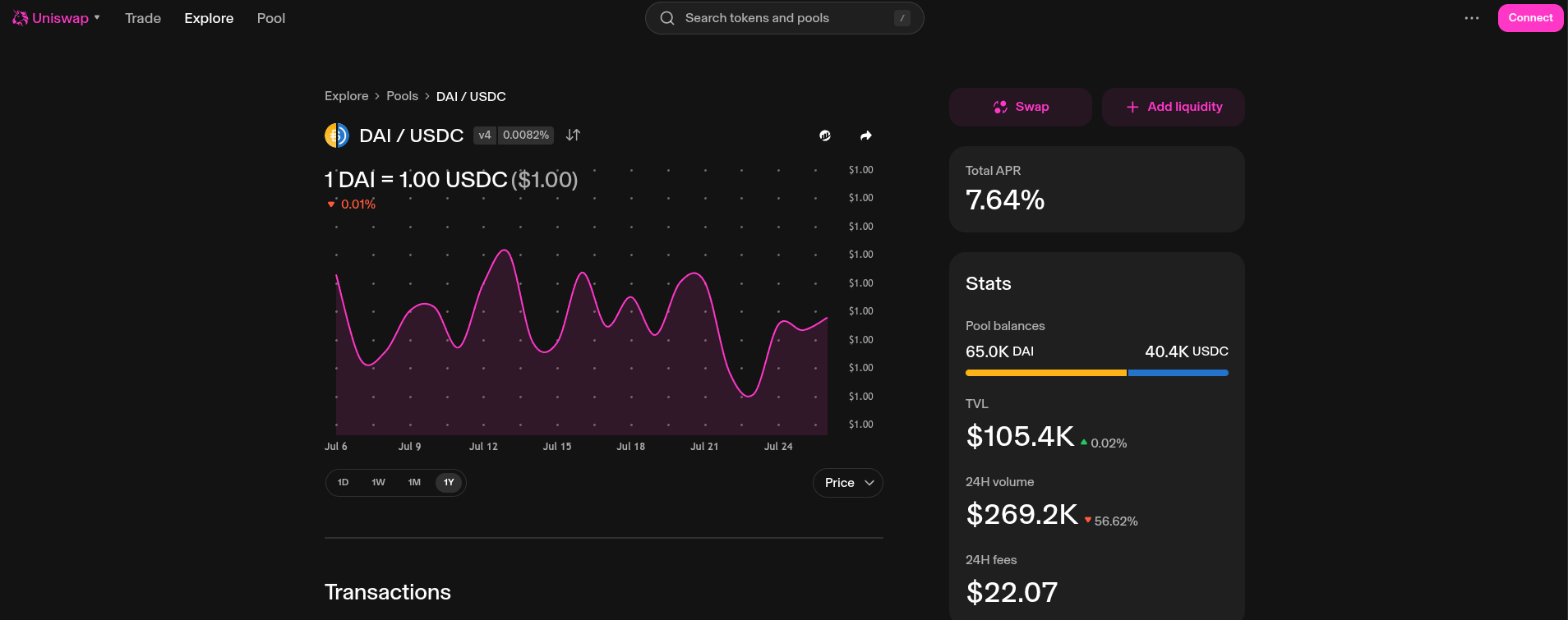

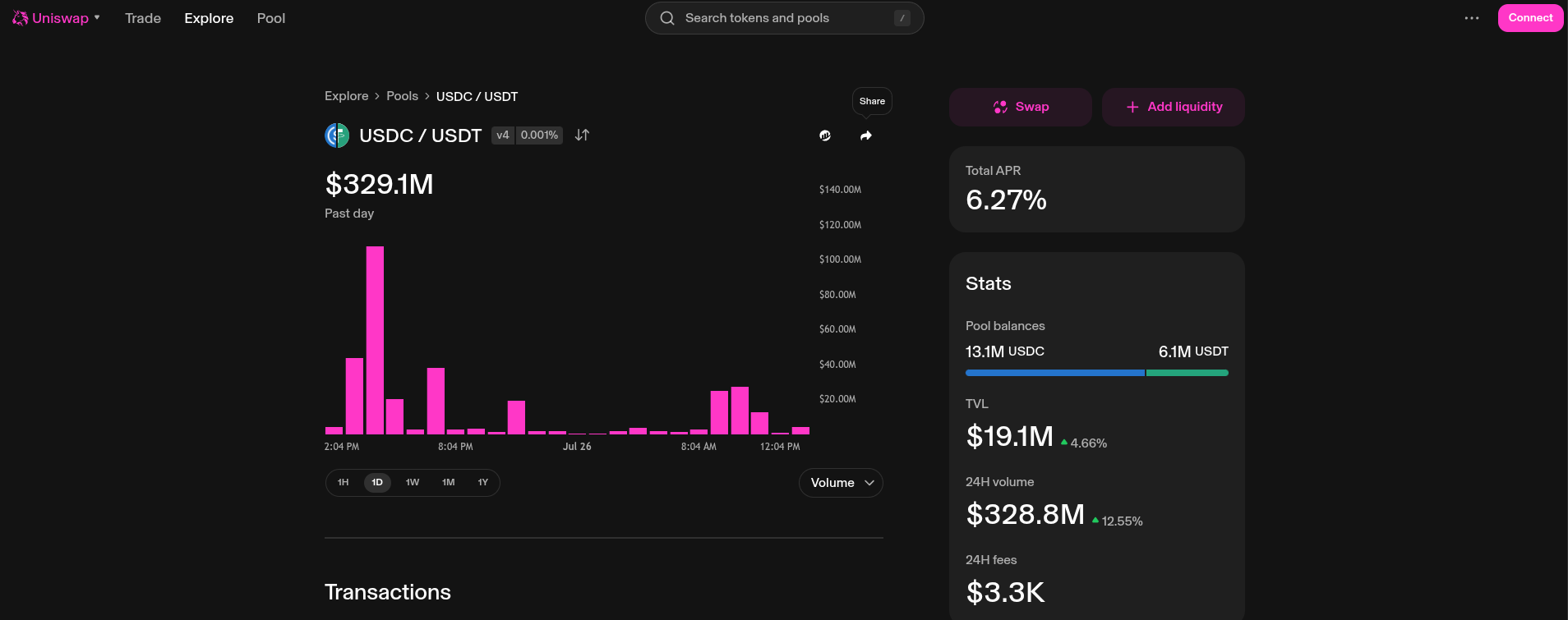

- LPing into a DEX with Stablecoins (e.g., QuickSwap V3 with USDC/USDT or the Uniswap Equivalent Pool)

Risk Level: Low to Moderate, slightly higher than simple stablecoin lending due to the introduction of Impermanent Loss, even if minimal.

Why:

- Low Impermanent Loss (with stablecoins): As discussed, since both assets in the pair aim for $1, their relative price movement is minimal. This means impermanent loss is significantly reduced compared to volatile pairs (like ETH/MATIC).

- Earns Trading Fees: You earn fees from every swap, which can be a consistent source of yield.

- Additional Farm Rewards: Often boosted by liquidity mining incentives (like QUICK tokens), which can enhance overall APR.

Primary Risks:

- Residual Impermanent Loss: Even with stablecoins, minor de-pegs can occur. If USDC goes to $0.998 and USDT stays at $1.000 for a period, you will incur a small amount of impermanent loss. If one stablecoin suffers a significant de-peg, your IL could become substantial.

- Smart Contract Risk: Vulnerabilities in the DEX’s (e.g., QuickSwap’s) smart contracts.

- Oracle Risk: Less direct than lending protocols, but if a DEX’s internal price discovery mechanism or external oracle (if used) is manipulated, it could lead to issues.

- Concentrated Liquidity Management (V3 specific): If you set a tight price range and the price moves outside that range, your liquidity becomes inactive and stops earning fees and rewards until the price returns or you adjust your range. This requires active management or reliance on automated tools, adding a layer of complexity and potential for missed earnings.

- Centralization Risk of Stablecoins: Same as lending, if one of the stablecoins significantly de-pegs.

See the difference in APR (and total value locked)

With a higher risk of impermanent loss, you have the USDT/ETH

- Staking (especially direct PoS staking of volatile assets or complex liquid staking/restaking)

- Risk Level: Generally the highest risk among these three, especially for direct staking of volatile assets or using newer, more complex staking derivatives.

- Why:

- Price Volatility of Staked Asset: This is the dominant risk. If you stake ETH, and ETH’s price drops significantly, the value of your principal can decrease dramatically, potentially offsetting or even overshadowing any staking rewards.

- Slashing Risk: Unique to Proof-of-Stake. If the validator you stake with (or if you run your own) acts maliciously, goes offline for extended periods, or makes errors (e.g., double-signing), a portion of your staked assets can be “slashed” (forfeited).

- Lock-up/Liquidity Risk: Traditional staking often involves unbonding periods (e.g., 7-28 days on many chains). During this time, your assets are locked and cannot be traded or moved, leaving you exposed to price drops without the ability to react. Liquid staking mitigates this but introduces new risks (see below).

- Primary Risks (beyond price volatility):

- Smart Contract Risk: For staking pools or liquid staking protocols (e.g., Lido, Rocket Pool), bugs in their smart contracts could lead to loss of staked funds.

- De-peg of Liquid Staking Token (LST): If you’re using liquid staking, there’s a small risk that the LST (e.g., stETH) could temporarily de-peg from the underlying staked asset (ETH), creating arbitrage opportunities but also potential losses if you need to sell the LST at a discount.

- Centralization Risk (for some staking pools): While the blockchain itself is decentralized, large liquid staking providers can accumulate significant control over the network’s stake, posing a centralization risk to the underlying blockchain’s decentralization.

- Oracle Risk: Used in liquid staking for redemption rates.

- Restaking Risks (Emerging): Restaking introduces additional smart contract risks from the “actively validated services” (AVSs) you’re securing, and potential for additional slashing if those AVSs have their own slashing conditions. This is a very new and potentially higher-risk frontier.

Summary (General Ranking of Risk, for the AVERAGE User):

- Lending Stablecoins: Lowest relative risk. Main concern is smart contract vulnerability and potential stablecoin de-pegging.

- LPing Stablecoins on a DEX: Low to moderate risk. Adds minor impermanent loss risk compared to lending, plus smart contract risk, and the operational complexity of V3 concentrated liquidity.

- Staking Volatile Assets (especially direct PoS): Highest risk among these. Dominated by the volatility of the underlying asset, plus slashing risk, smart contract risk, and potential liquidity lock-ups. Liquid staking and restaking add layers of complexity and their own specific risks.

. Always do your own research (DYOR) and understand the specific protocol’s mechanics and audits before committing capital to any DeFi activity!!

Difference Growth Rates KPIs

You will need to understand a very important distinction in finance and especially in crypto!

APR and APY are both ways to express interest rates over a year, but they differ significantly in how they account for compounding.

In traditional Finances, as seen within real estate, it was interesting to get to know the CAGR.

But while you explore Defi Protocols, these will pop up: APR and APY

The Critical Difference:

APR is the simple annual rate. If compounding occurs more frequently than annually, the actual earnings will be higher than the APR.

APY is the effective annual rate that already includes the effect of compounding. It tells you the true percentage gain on your initial principal over a year.

Therefore, when you see an “APY” figure on QuickSwap or any other DeFi protocol, it’s designed to give you the most accurate picture of your annual returns, taking all compounding into account.

If they stated an “APR,” it would be a lower number, and you’d need to manually calculate the APY based on the compounding frequency to understand your true annual return.

APR (Annual Percentage Rate)

- What it is: The Annual Percentage Rate (APR) is the simple interest rate for a year, without taking into account the effect of compounding within that year. It represents the annual cost of a loan or the annual earning rate of an investment before considering the “interest on interest.”

- Key Characteristics:

- Simple Interest: APR is based on simple interest. It’s the periodic interest rate multiplied by the number of periods in a year.

- No Compounding: It does not account for interest being added to the principal more frequently than annually.

- Context: Primarily used for loans (mortgages, car loans, credit cards) to show the basic cost of borrowing. A lower APR is better when you’re borrowing. It’s also used in some DeFi contexts to indicate a base rate before any compounding.

- Example: If you have a loan with a 12% APR compounded monthly, the interest rate per month is 1%. The APR is just 1% * 12 months = 12%.

APY (Annual Percentage Yield)

- What it is: The Annual Percentage Yield (APY) is the actual rate of return on an investment or savings account over a year, taking into account the effect of compounding interest. It shows you how much your money will actually grow over a year if the int

What it is an order book

The chaos of the market in one place: https://www.coinglass.com/merge/BTC-USDT

An order book is a digital list that displays all the buy and sell limit orders for a specific asset on a trading exchange. It’s essentially a real-time record of market interest, providing a snapshot of the supply and demand for a particular security, cryptocurrency, or other financial instrument.

Key Components of an Order Book

An order book is typically divided into two sides:

- Bids (Buy Orders) 🟢: The list of open orders from people who want to buy the asset. They are arranged in descending order by price, with the highest price a buyer is willing to pay at the top.

- Asks (Sell Orders) 🔴: The list of open orders from people who want to sell the asset. They are arranged in ascending order by price, with the lowest price a seller is willing to accept at the top.

The difference between the highest bid and the lowest ask is called the bid-ask spread. This spread is a key indicator of the asset’s liquidity and is where a trade can be executed.

How it Works

The order book only lists limit orders, which are orders to buy or sell an asset at a specific price or better.

When a trader wants to execute a trade immediately, they place a market order, which is filled instantly by matching with the best available limit orders in the order book.

For example, if you place a market order to buy 10 units of an asset, the matching engine will fill your order by taking the first available sell orders from the “asks” side of the order book, starting with the lowest price, until your entire order is filled.

This is why a large market order can “walk up” the order book and get filled at different, increasingly higher prices.